Justin Sullivan/Getty Images News

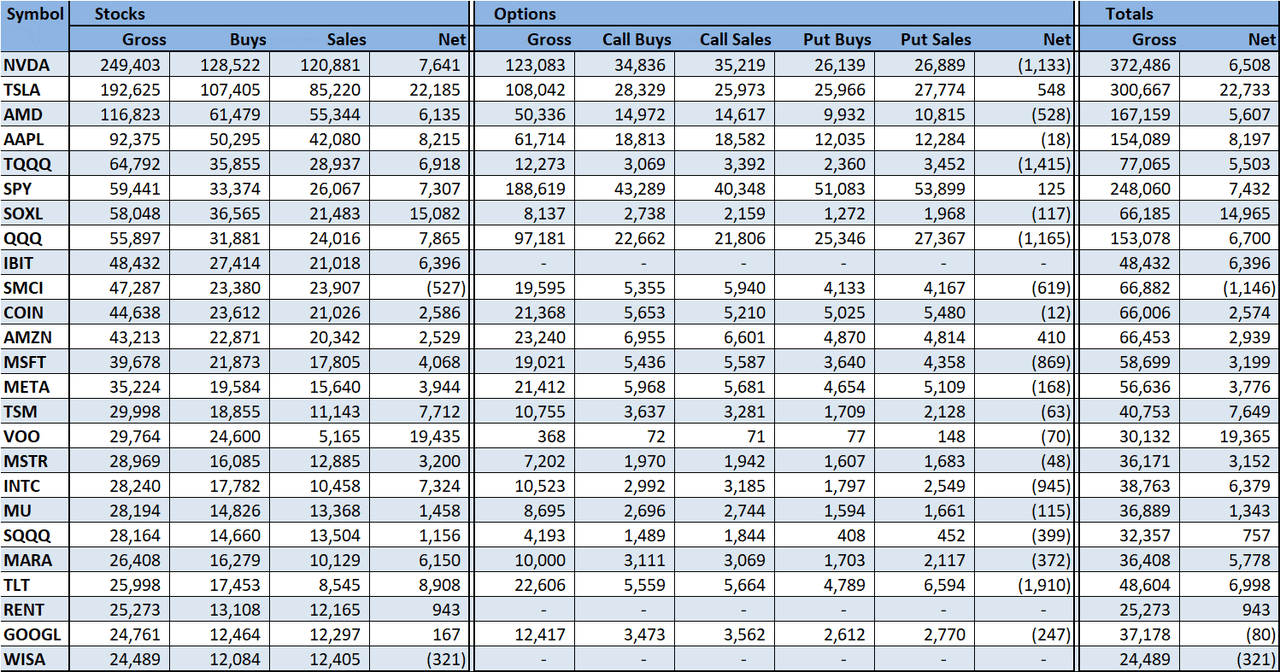

Nvidia (NVDA) has regained the top spot on Interactive Brokers’ (IBKR) weekly list of the 25 most-traded stocks and options on its trading platform during what has been a “chaotic” run through the markets recently.

The AI chip maker saw a gross result 372.5K traded stocks and options on the IBKR platform during the five business days leading up to the release of Interactive Brokers’ (IBKR) list of the 25 most active stocks on Wednesday.

That activity has surpassed that of Tesla (TSLA), which IBKR called the platform’s “former perennial leader” earlier this month. In Wednesday’s update, Tesla recorded a total of 300.7K gross trades across stocks and options.

“Despite — or more likely because of — recent geopolitical concerns,” IBKR’s most active list was “largely populated by the usual suspects,” Steve Sosnick, IBKR’s chief strategist, said this week in an emailed note .

Semiconductor company Advanced Micro Devices (AMD) was third on this week’s most active list, with 167.2K of stock and options trades, followed by Apple (AAPL) with 154.1K of trades. The ProShares UltraPro QQQ ETF (TQQQ) rounded out the top five with just over 77,000 trades. The leveraged Exchange Traded Fund provides 3x daily exposure to the performance of the Nasdaq 100 (NDX).

“Traders tend to stick with what they know during chaotic markets. NVDA is back on top, which is slightly surprising considering the heavy news flow in TSLA, and much of the list is populated by mega tech stocks capitalization, linked crypto-games and index-based ETFs,” Sosnick said.

Below is the complete data on the IBKR 25 most active list:

Note: This data shows the number of IBKR client orders, not the number of shares traded.

US stocks have been selling off in recent sessions, hit by the scaling back of rate cut expectations. Bond yields, at the same time, have risen as investors abandon fixed-income assets. Underscoring rate concerns, Federal Reserve Chair Jerome Powell this week said recent data showed a lack of progress on inflation. The S&P 500 Index (SP500) posted its fourth consecutive loss on Wednesday, snapping its longest losing streak since earlier this year.

Tesla (TSLA) investors in recent days have weighed in on the company’s plan to lay off more than 10% of its global workforce, news of a delay in Cybertruck deliveries, a 50% price cut on its monthly subscription to Tesla’s full self-driving (TSLA) package and the alleged resignations of two top executives.

Meanwhile, the electric vehicle giant on Wednesday asked shareholders to vote in favor of Elon Musk’s $56 billion 2018 compensation package at its annual meeting in June. set for June 13th. A Delaware judge invalidated the compensation package earlier this year.

Tesla’s first-quarter earnings report is due on April 23.