Oil futures fell Wednesday, driven in part by official data showing weekly increases in U.S. crude and gasoline supplies.

Traders also weighed concerns about the global demand outlook against the threat of escalating tensions in the Middle East.

The price moves

-

West Texas Intermediate crude oil for delivery March CL00,

-1.91% CL.1,

-1.91% CLH24,

-1.91%

fell $1.62, or 2.1%, to $76.20 a barrel on the New York Mercantile Exchange, trading up 6% for the month. -

March Brent crude BRNH24,

-1.17% ,

the global benchmark, fell 90 cents, or 1.1%, to $81.97 a barrel on ICE Futures Europe, forecasting a 6.4% monthly gain on the contract’s expiration day. April Brent BRN00,

-1.59% BRNJ24,

-1.59% ,

the most actively traded contract fell $1.13, or 1.4%, to $81.37 a barrel. -

February petrol RBG24,

-2.58%

lost 2.8% to $2.2195 a gallon, while February HOG24 heating oil,

-0.10%

it lost nearly 0.1% to $2.805 a gallon. Both traded higher for the month, before their expiration at the end of the session. -

Natural gas for delivery March NGH24,

+2.07%

trading at $2.112 per million British thermal units, up 1.8% in trading on Wednesday, with the contract down more than 9% for the month.

Provide data

The Energy Information Administration on Wednesday reported a surprise weekly increase in U.S. commercial crude inventories, which rose by 1.2 million barrels in the week ending Jan. 26.

On average, analysts surveyed by S&P Global Commodity Insights expect a weekly decline of 2.3 million barrels. Late Tuesday, the American Petroleum Institute reported a decline in inventories of 2.5 million barrels, according to analysts.

The EIA report also revealed a weekly increase in gasoline supply of 1.2 million barrels, while distillate inventories fell by 2.5 million barrels. The S&P Global Commodity Insights survey of analysts showed forecasts for inventory losses of 450,000 barrels for gasoline and 700,000 barrels for distillates.

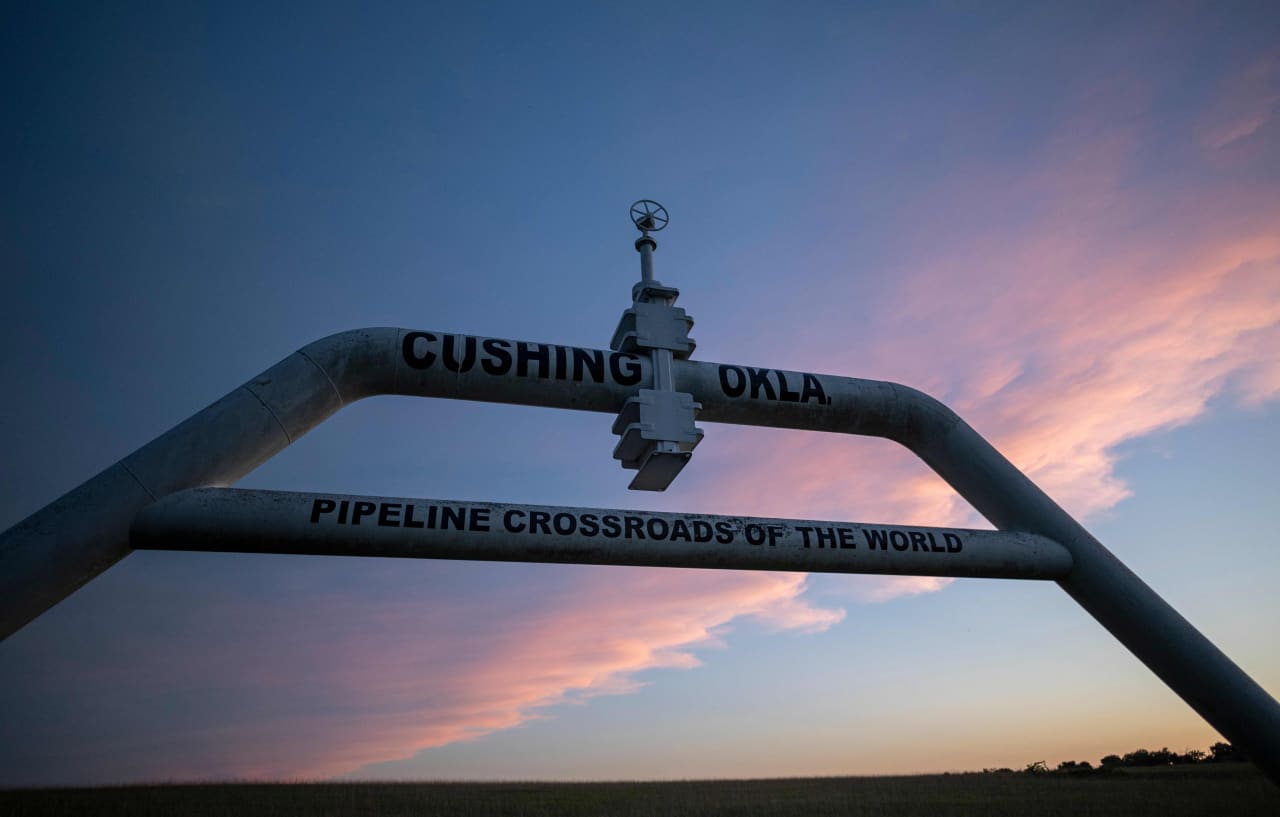

Crude inventories at the Cushing, Okla., delivery hub Nymex fell by 2 million barrels last week, the EIA said, while U.S. oil production rose by 700,000 barrels to 13 million barrels a day. day. Freezing U.S. weather the week before had disrupted production, leading to a drop of 1 million barrels.

Other market drivers

Overall, “the market is moving cautiously ahead of the potential US upside. response to the recent assault in Jordan and how Iran will react in turn,” Ewa Manthey and Warren Peterson, strategists at ING, said in a note.

Oil futures have seen choppy trading this week, tumbling Monday on concerns about the outlook for crude demand from China after Evergrande’s orderly liquidation fueled worries about the impact of the country’s troubled real estate sector on the second-largest economy of the world.

Those concerns appear to outweigh worries about an escalation of tensions in the Middle East that could threaten crude supplies after a drone attack over the weekend by Iranian-backed militants killed three U.S. soldiers in Jordan.

However, traders need to “look at what the US response will be” to the tragic loss of life over the weekend, said Tariq Zahir, managing member at Tyche Capital Advisors. “If we saw a response on Iranian soil, we could see the energy markets really go up.”

“For now we are entrenched in a risk-off environment,” he told MarketWatch.