“Is Nvidia the Cisco of today? It’s possible. If so, then it will have a lot more upside before it collapses, if it collapses.“

Is it possible that the bull market meltdown phase (which started on October 12, 2022) has already begun, after starting to track the correction low of October 27, 2023? Yes, it is possible.

After the recent low, investors have become much less concerned about adverse macroeconomic issues such as recession, higher interest rates, persistent inflation and the federal government deficit. Instead, they are excited about the likelihood that the U.S. Federal Reserve will cut interest rates this year as inflation continues to decline. They are also exuberant about the potential impact of artificial intelligence (AI) on tech companies’ profits.

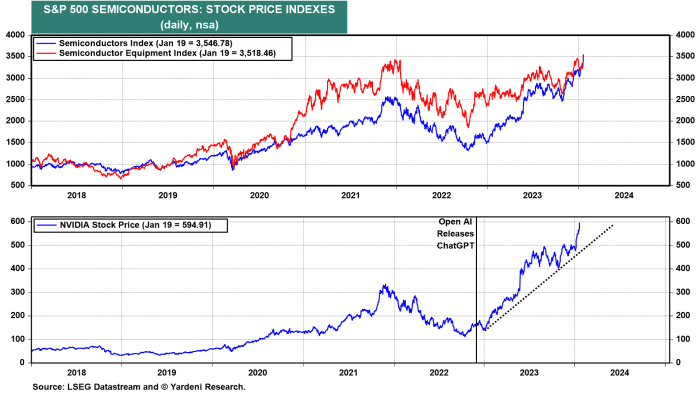

Their AI exuberance began when OpenAI introduced ChatGPT on November 30, 2022. Since then, Nvidia’s NVDA,

the stock is up more than 250% because it is the leading semiconductor maker of AI chips. Since then, the S&P 500 Semiconductor stock price index has posted a gain of 108%.

Nvidia’s stock price performance is starting to remind us of the parabolic rise of Cisco Systems CSCO,

stocks during the tech bubble of the late 1990s. The company made critical equipment needed to expand the Internet, and its stock price increased eightfold from late 1997 to March 2000. The stock then plummeted, even as the Internet continued to proliferate rapidly.

Is Nvidia the Cisco of today? It’s possible. If so, then it will have a lot more upside before it collapses, if it collapses.

Fed Chair Jerome Powell has studied the history of Fed chairmen, particularly Paul Volcker. Unlike Volcker, Powell may be able to reduce inflation without a recession. Financial markets expect him to lower interest rates this year, now that his inflation mission is almost accomplished. In fact, he and other Fed officials have said they may have to lower the federal funds rate to prevent the inflation-adjusted federal funds rate from rising as inflation falls further.

“When bubbles swell to a certain point, it doesn’t take long for them to pop.“

In this scenario, Powell risks fueling irrational exuberance, a phenomenon discussed by former Fed Chairman Alan Greenspan in his famous December 5, 1996 speech titled “The Challenge of Central Banking in a Democratic Society.” He was simply thinking aloud, pondering like Hamlet on an important question: “How do we know when irrational exuberance has unduly increased asset values, which then become subject to unexpected and prolonged contractions…? And how do we incorporate this assessment into monetary policy?” But that term “irrational exuberance” struck a chord with investors and became a self-fulfilling prophecy. When bubbles swell to a certain point, it doesn’t take long for them to pop.

The financial press recently reported that money market mutual funds (MMMFs) attracted a record $6 trillion in assets, including $2.3 trillion in retail MMMFs and $3.6 trillion in institutional accounts. If the Fed lowers interest rates, much of that money could move into the bond and stock markets, fueling a crash in both markets, particularly the stock market.

Over the years, we have learned that recessions can be caused by bursting asset bubbles. If Powell and his colleagues took a victory lap and celebrated their success in reducing price inflation without causing a recession by lowering interest rates, they would run the risk of fueling asset inflation. When the bubble were to burst, a recession would most likely result.

The Fed’s last big mistake was falling behind the inflation curve in 2021 and early 2022. The Fed’s next big mistake could be to inflate a stock market bubble. Powell must know. If so, then he should reiterate that he is in no rush to lower interest rates.

So instead of a repeat of the inflation of the 1970s or the productivity-driven boom of the 1920s, the current decade has the potential to play out like the technology-driven stock market party of the 1990s. To quote Prince: “Let’s party like it’s 1999.”

Ed Yardeni is president of Yardeni Research Inc., a provider of global investment strategy and asset allocation analysis and recommendations. This article is excerpted from Yardeni Research’s “Deep Dive” on January 26, 2024. Individual investors can read Yardeni’s research here. Follow him on LinkedIn and his blog.

Moreover: 12 Reasons You’ll See the S&P 500 at 5,400 in 2024

More: 5 real risks that could crush stocks in 2024 and why they won’t