Nvidia Corp. just gave the world details of its historic financial year. Its reward: the expectation that the chipmaker will make something that’s never been done before.

When Nvidia NVDA,

ended the fiscal year with an earnings report last week, the surprising numbers sent the stock to record highs and pushed the indexes to all-time highs. The company’s market capitalization is around $2 trillion, and its shares have risen nearly 1,900% over the past five years.

But if you think carefully about some of the numbers included in Nvidia’s recent financial report, you’ll realize just how incredible Nvidia’s last financial year was. It truly is one for the record books.

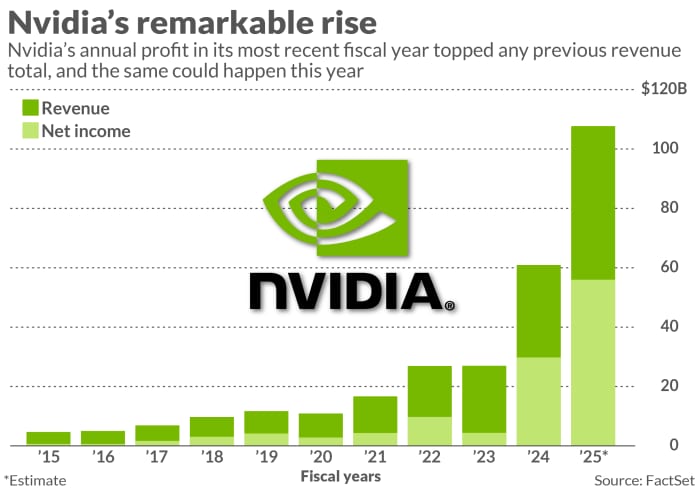

Nvidia in its 2024 fiscal year produced a profit of $29.76 billion, a feat in itself. But that number is even more eye-popping when compared to Nvidia’s past performance: The chipmaker had never before produced an annual report income such a high total in its 25 years as a public company, with sales topping the previous year at $26.97 billion.

The Dow Jones Market Data team analyzed data from those 25 years and found that no company had ever achieved a similar feat on the scale of Nvidia. Since 1999, nearly 300 companies have produced profits higher than any previous revenue, but most were much smaller companies that produced profits of less than $1 billion in record years.

More from Jeremy: Will Nvidia Stock Be More Like Apple or Cisco in the Age of AI?

Previously, the highest total profit that exceeded any previous revenue total belonged to Moderna Inc. MRNA,

The vaccine maker produced a profit of $12.2 billion in 2021 after introducing its COVID-19 vaccine, but that profit was less than half of what Nvidia made last year. Only three other companies have surpassed $10 billion in achieving the feat: another vaccine maker, BioNTech SE BNTX,

in 2021; Gilead Sciences GILD,

in 2014, thanks to Sovaldi; and Charter Communications Inc. CHTR,

in 2009, which was largely a paper profit from emerging from bankruptcy proceedings.

There is a possibility that Nvidia’s record will not hold up for long, as it could collapse this year. But Nvidia would be the one to break it: After making $60.9 billion in revenue last year, Wall Street expects a profit of nearly $56 billion this year. And analyst projections have consistently fallen short of Nvidia’s actual performance in recent quarters.

However, these earnings expectations also stand out in another way. After last week’s stunning earnings report, analyst forecasts have risen to the point that Wall Street now expects Nvidia to surpass $100 billion in revenue this year, a barrier even for Intel Corp. INTC.

it has never broken.

Opinion: Nvidia is seeing a boom in generative AI, but don’t bet on it spreading to the rest of the tech

When we put revenue and profit expectations together, something stands out: margin. Wall Street expects Nvidia to take home more than 50 cents for every dollar it raises in net revenue this year, which would set a record that doesn’t need the qualification “on that scale.”

Dow Jones Market Data analyzed financial records dating back to 1999 and found no company that has ever produced $100 billion in revenue with a net profit margin higher than 50%. If Nvidia lived up to – or beat – Wall Street’s expectations, it would be the first company to achieve such a feat.

For more on how Nvidia got to this point and what it means for the market, listen to this week’s On Watch by MarketWatch podcast.

Check out MarketWatch’s On Watch, a weekly podcast about the financial news we all watch and how it impacts your portfolio. MarketWatch’s Jeremy Owens focuses his attention on what drives the markets and offers insights that will help you make more informed financial decisions. Subscribe on Spotify and Apple.