Key points

- Options collars can be used to hedge and preserve profits on stocks in your portfolio.

- Option collars have two legs: a covered call and a long put option.

- Mark Cuban used collar options to protect his $1.4 billion in Yahoo restricted stock he received when his company Broadcast.com was acquired shortly before the dot-com bubble burst when Yahoo! it dropped from $250 to under $30.

- 5 stocks we prefer to Intel’s

The bull stock market seems to be hitting new highs every week. You’ll likely want to protect some of these profits if you’ve ridden the market recovery following the pandemic sell-off. Selling your winners would result in a capital gains tax bill, not to mention the potential loss of future earnings. Instead, if what you’re most concerned about is protecting your downside, consider using an options manifold strategy. It works on any option stock in any stock sector of the stock market.

What is an optional collar?

Of course, it requires basic knowledge of options trading. You also need to be familiar with writing a covered call. You could write a covered call to collect rent, but what happens if the market crashes and the premiums collected don’t cover the fire sale? You could buy puts to hedge your gain, but that’s like paying for an insurance policy every few months, which can add up. However, the combination of the two strategies constitutes the two legs of an options collar.

Mark Cuban’s options collar strategy saves his Yahoo stock.

During the infamous dot-com bubble of 2001, many dot-com millionaires went bankrupt while holding onto their stocks as most Internet stocks crashed and never recovered. In April 1999, Yahoo! has acquired Broadcast.com, Mark Cuban’s Internet streaming local sports broadcast startup, for $5.7 billion in an all-stock transaction. Cuban received 14.6 million restricted shares of Yahoo! action.

A year later, the dot-com bubble began to burst when Yahoo! the stock fell from $250 in January 2000 to less than $30 by the end of the year. Because Cuban had experience in day trading, he anticipated the bubble bursting and implemented an options collar to protect his Yahoo shares during the crash since he was barred from selling them outright.

Cuban managed to cash in on his Yahoo! share relatively unscathed, later raking in more than $1 billion in proceeds, while numerous Internet billionaires lost their fortunes in the crash. Cuban placed an options collar by selling cover calls at a $205 strike price and buying puts at $85 when Yahoo! the shares were trading at around $95 at the time he made the trades.

The mechanics of an options collar

The optional collar has two legs. If you’re familiar with writing covered calls, the collar is just an extra step after purchasing a protective put. Therefore, you will first write the covered call on the stock you own and then purchase a put on the same stock. Strike prices will be based on support and resistance levels.

Identify the trading range.

Let’s use Intel Co. NASDAQ: INTC on the daily candlestick chart. The first step is to identify a trading range.

Since INTC’s earnings gap narrowed, INTC has consistently peaked and fallen below the resistance of the $45 area. Its support levels were held at the $42.40 level. Assuming we want to protect our profits in INTC stock, we can run an options collar to protect ourselves from a sharp sell-off for the next 31 days. You can run the option collar further out, but for example, we will do 31 days of protection expiring on April 5, 2024.

Put on the market

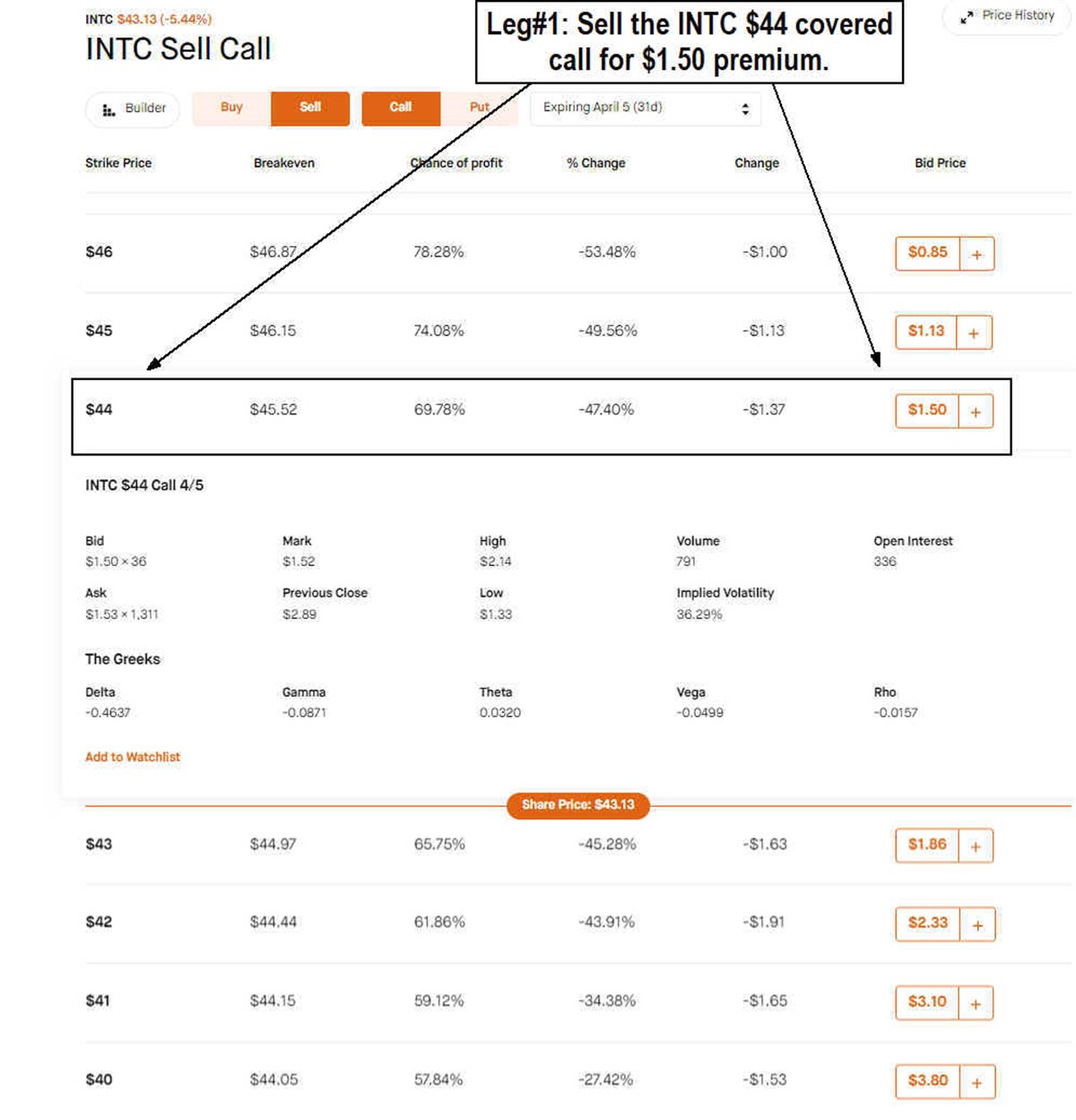

On March 5, 2024, INTC was trading at approximately $43.18. To execute the option collar, we must first write a cover call with an expiration date of April 5, 2024, for leg no. 1.

We can write the INTC $44 strike covered call for $1.50. This gives us protection up to $41.60, which is calculated as $43.10 INTC minus the $1.50 call premium. The call option also provides additional upside potential of 82 cents if INTC closes above the $44 strike on April 5, 2024. This means that if INTC rises above $44 at expiration, we will receive an extra 88 cents per share when our positions will be called back. distant.

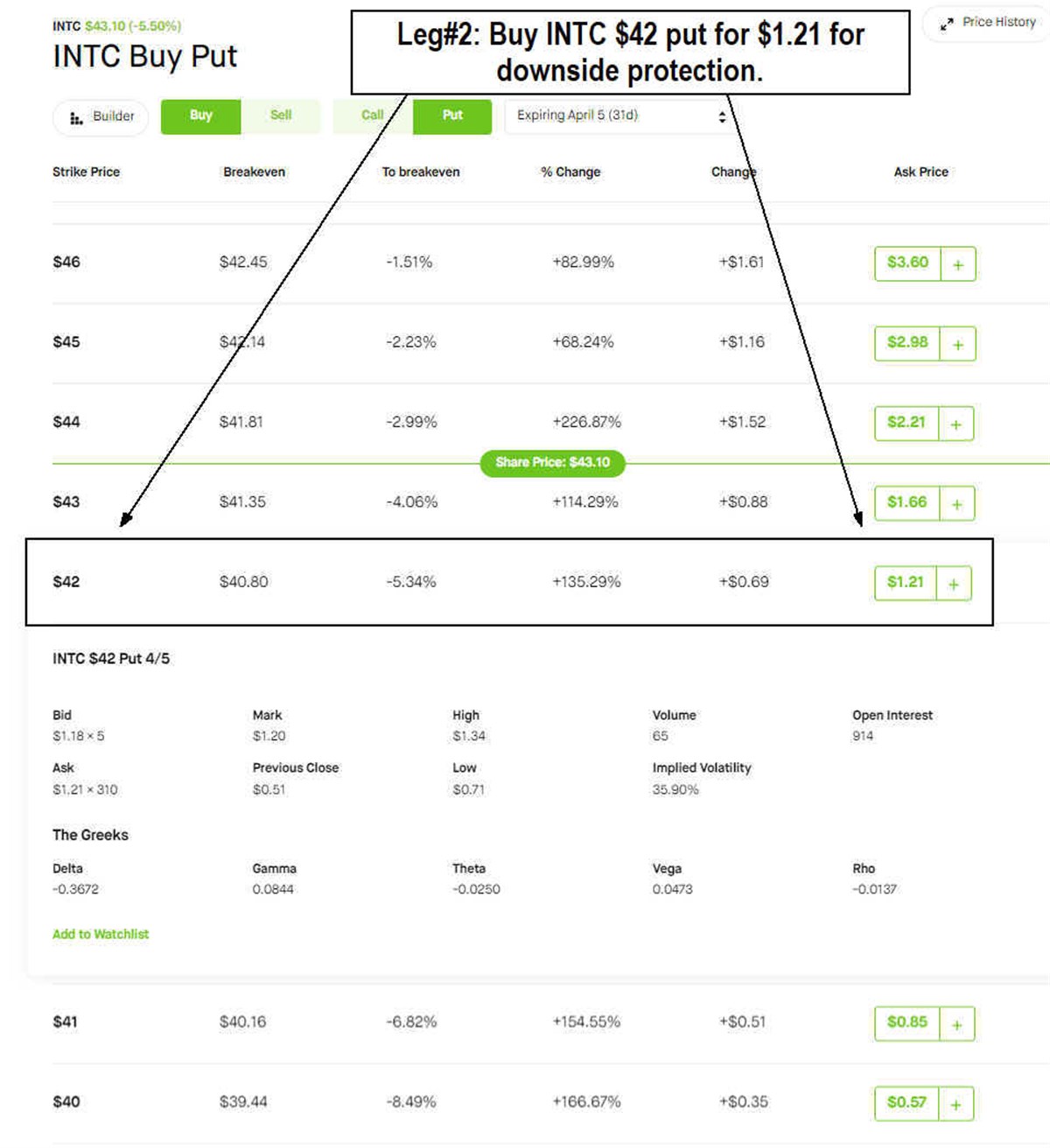

For leg no. 2, we want to add protection from a much deeper sell-off within the next 31 days below our buffer price of $41.40. We can buy a $42 put contract at $1.21. This means that if INTC falls below $42, we are protected no matter how much below $42 as the contract will rise in value. Since we use the proceeds of the $1.50 covered call premium to pay the cost of the $1.21 put contract, we are left with 29 cents of premium remaining to keep.

Possible results

Upon expiry, if INTC closes between $42 and $44, so we hold our INTC stock. The call option expires worthless, meaning we keep the $1.50 call premium. The put option expires worthless, meaning we lost the $1.21 we paid for the contract. This leaves us with original INTC shares long and a premium profit of 29 cents.

Self INTC closes above $44, our INTC stock picks up at $44 for a profit of 88 cents. We still keep the $1.50 premium minus the $1.21 paid for the put option, which expires worthless. That leaves us with A total of $1.17 in additional profits.

Self INTC closes below $42, we are protected from the downside as our puts increase in value. The calls expire worthless, so we keep the $1.50 premium minus the $1.21 paid for the put option. That leaves us with the original INTC shares and a premium profit of 29 cents.

When to collapse stocks

Although we have used a situation where you can protect your profits with a collar strategy, you can also use this strategy for income. When you select the right strike price combinations, the premium remains as profit, as seen in the INTC example. In future articles we will present more setup cases so that you can apply them to your portfolio as you become more familiar with options trading.

Before considering Intel, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Intel wasn’t on the list.

While Intel currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

MarketBeat analysts just released their top five short stocks for March 2024. Find out which stocks have the most short interest and how to trade them. Click the link below to see which companies are on the list.

Get this free report