shapecharge/E+ via Getty Images

In evaluating community banks in the northeastern United States, Piper Sandler analyst Mark Fitzgibbon sees 2024 as “another potentially good year for banks with larger asset management units.”

In his long-term view, “there is a huge need for capable wealth management providers,” he explains to the aging baby boomer population, the largest intergenerational transfer of wealth in US history, the increased complexity of financial products and the increased volatility of markets.

Fitgibbons points to five stocks that have relatively larger wealth management businesses in the Northeast community banking sector: Cambridge Bancorp (NASDAQ:CAT), Independent Bank Corp. (NASDAQ:INDB), Peapack-Gladstone Financial (NASDAQ:PGC), Social Security Financial Services (NYSE:PFS) and Washington Trust Bancorp (NASDAQ: WASH).

“We believe these companies will benefit disproportionately from a recovery in the stock and bond markets,” he wrote in a note to clients.

The two names with the most attractive valuations and that “represent the most attractive investment candidates” are Peapack-Gladstone (PGC) and Provident Financial Services, (PFS), both rated Overweight, Fitzgibbon said. Each trades at a steep discount to peers on both tangible book value and EPS basis, she noted.

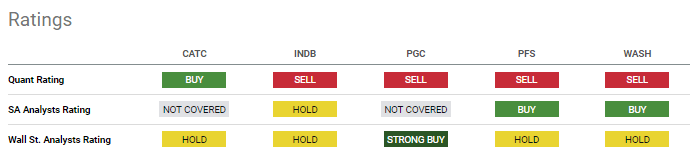

It has Neutral ratings on Cambridge Bancorp (CATC) and Independent Bank (INDB) and an Underweight rating on Washington Trust (WASH).

The SA Quant Rating only has a buy rating on CATC, with sell ratings on the other four stocks.

In Monday afternoon trading, CATC stock increased by 1.1%Independent Bank gained 1.3%Peapack-Gladstone Financial (PGC) rose 1.7%Retirement Financial Services (PFS) increased by 0.6%and the Washington Trust (WASH) crept in up by 0.3%.