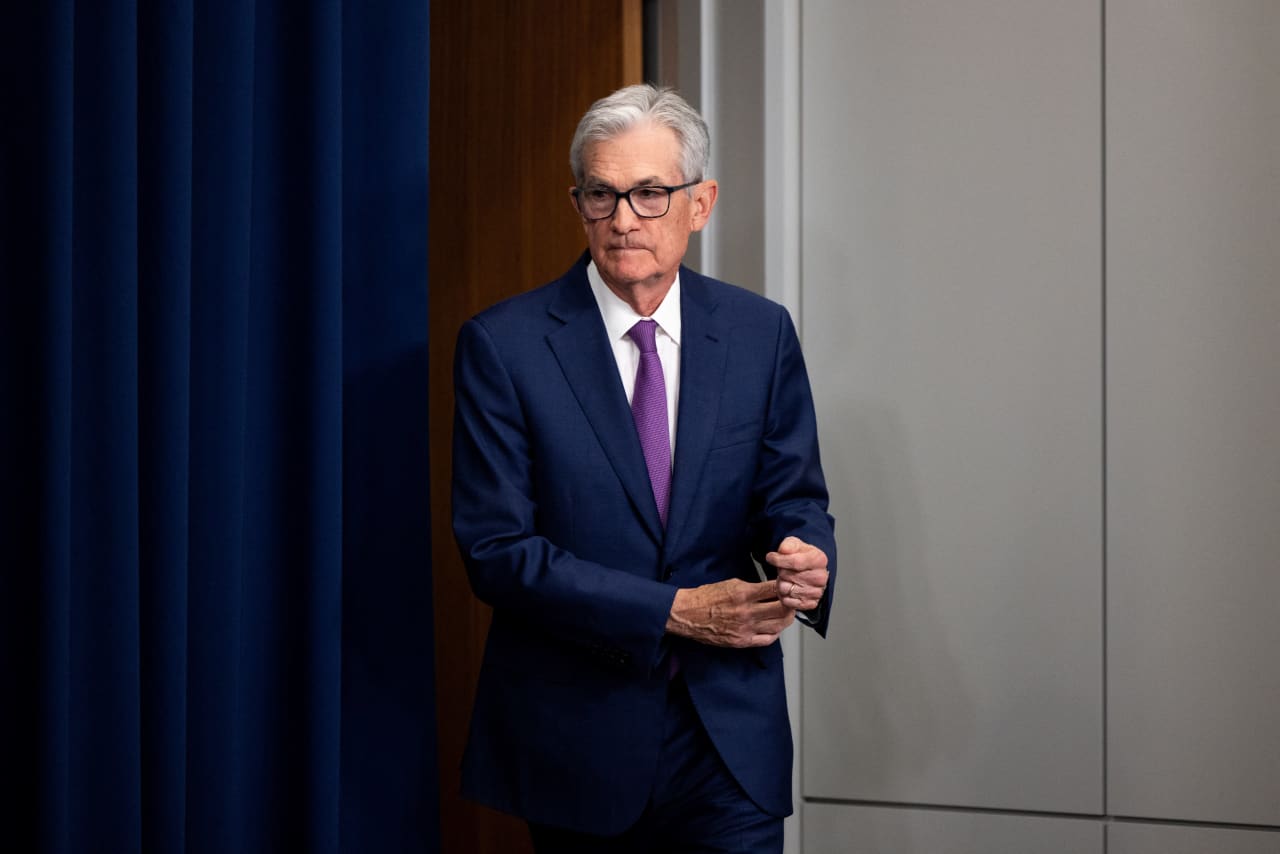

Federal Reserve Chair Jerome Powell on Sunday said the strength of the economy allows the Fed to be “careful” in deciding when to cut interest rates.

“With the economy being strong … we feel like we can carefully approach the question of when to start reducing interest rates,” Powell said, in an interview broadcast on CBS News’ “60 Minutes.”

The Fed chair stressed that the central bank is “actively considering” when to proceed with the rate cut and will not wait until inflation returns to the 2% target.

“My colleagues and I are trying to choose the right point from which to begin scaling back our restrictive policy stance,” Powell said. “That time is coming.”

The Fed is trying to balance the risk of cutting too early, which could undermine its progress on inflation, and the risk of cutting too late, which could lead to a recession.

“The prudent thing to do is to give yourself some time and see that the data continues to confirm that inflation is falling to 2% sustainably,” Powell said.

Last week, the Fed’s policy statement said the central bank wanted to be more confident that inflation was moving toward its 2% target.

Powell later told reporters that the committee was unlikely to reach that level of confidence by the March meeting, which is seven weeks away.

The Fed chair repeated these comments in the interview.

A rate cut in March “is not the most likely or baseline case,” he said.

Powell noted that only “a couple” of the 19 top Fed officials do not want to cut interest rates this year. This means there is overwhelming support for the cuts.

“And so, it’s certainly as a basis that we’re going to do that,” Powell said. “We’re just trying to pick the right time, given the overall context.”

After Friday’s strong jobs report, traders in derivatives markets see more than a 70% chance that the first rate cut will occur in early May. They expect rate cuts of five quarter points this year.

The yield on the 10-year Treasury note BX:TMUBMUSD10Y rose in Sunday evening trading.

Powell faced barrage of questions from “60 Minutes” correspondent Scott Pelley. Here are some key points he highlighted.

-

“The economy is in a good place and there is every reason to think it can improve,” Powell said.

-

Asked whether the Fed managed to achieve a soft landing, Powell responded: “I’m not ready to say that yet. We still have some work to do on this.”

-

“Geopolitical risks” represent the greatest threat to the world economy today.

-

In hindsight, the Fed should have raised interest rates sooner to fight inflation. “I’m happy to say that.”

-

The United States is on an “unsustainable fiscal path” and is now an “urgent problem” that requires attention as soon as possible.

-

The decline in the value of commercial real estate “appears to be a manageable problem” on the balance sheets of large banks. Smaller banks may be challenged and bank mergers or closures may occur.

-

The possibility of a recession is “not that high right now,” Powell said.