The first quarter of 2024 brought with it even more impressive gains, helping push the S&P 500 (SPY) to new heights. This is then… this is now. This means there is good reason to believe that the pace of earnings will slow dramatically. Steve Reitmeister, a 44-year investing veteran, is happy to share his updated market outlook along with his trading plan and top picks to outperform the rest of the year. Get the full story below.

It was nearly impossible to lose money in the first quarter, given the hefty 10% gain for the S&P 500 Index (SPY). Even more impressive was the 25% gain if you turn the clock back to early November 2023.

When you realize that the average annual gain for stocks is only 8%, then you understand that these good times won’t last.

No…this does not mean a bear market is coming. Except that the pace of these gains is expected to slow dramatically from here on out.

Our goal in today’s commentary is to recap the key details of the first quarter in hopes that it illuminates a path to superior returns in the months ahead.

Comment on the market

Throughout 2023 and into early 2024, the stock market has been a bit unbalanced. This is where most of the gains went to mega-cap tech stocks with smaller green arrows next to most other groups.

Therefore, the following graph of first quarter performance by market cap will not surprise you:

Once again, we see that the smallest stocks are lagging on the year (small, micro and nano). As shared with you several times in the past, small stocks have a distinct historical advantage over long caps going back 100 years. So, the 4-year lead for large caps is a bit of an anomaly.

In many ways, the fact that small caps are leading a bull market is the healthiest sign as it indicates that investors are willing to take risks. While loading up on the same 7 mega cap tech stocks seems a bit like adding blocks to a tower in the game of Jenga. It works for a while, then becomes too high and unstable leading to the fall. More on what this means in the outlook section later.

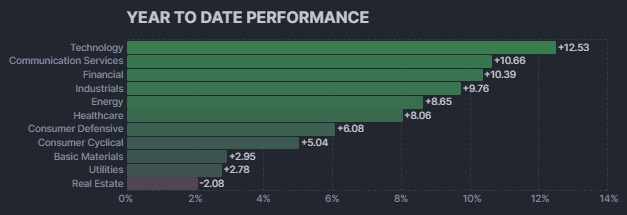

Now let’s check the 2024 performance by sector:

This is quite a repeat of 2023 with technology and communications services leading the way. While the more defensive groups (consumer defense, public utilities, healthcare) are placed in the middle-bottom position of the ranking.

This is quite typical for a bull market as technology and communications services are two of the most growth-oriented groups. The most surprising part is the weakness in basic materials and industrial sectors, which usually perform strongly in the early stages of a new bull market.

OK… that’s what happened as we are only 18 months away from the start of a new bull market. And given that they typically last more than 5 years, there is good reason to be optimistic that further upside can be expected. Yet, as predicted in the introduction… the pace of gains is expected to slow dramatically from here on out.

Market outlook and trading plan

I recently shared a much more comprehensive presentation on my stock market outlook for the remainder of 2024, including a trading plan and top picks to outperform. Watch it here >

The short version is that the easy money was made with a gain of around 50% in just 18 months. That’s because investors are doing their typical job of reading the playbook ahead of time.

By this I mean that investors are well aware that the Fed will lower rates this year, which will serve as a catalyst for higher economic growth. So they are bidding on the shares ahead of that action. This also opens the door to a rather lukewarm response to the actual rate cut which right now looks a lot like the one on June 12th.th Fed meeting.

Long story short, I suspect the S&P 500’s high this year will be around 5,500. A modest 5-6% increase from current levels. But more on par with the kind of realistic annual earnings you should expect as we move forward.

Yes, I know, it doesn’t sound too exciting for investors who simply want to take a spin on market indices. I’m happy to see a path to far superior results if you appreciate these superior stock selection criteria.

First, the 4-year advantage for large caps should end. I believe small caps could easily outperform the S&P 500 by 2-3x over the next couple of years.

Second, basic materials and industrial sectors are expected to outperform as lower rates also reduce their cost structure (especially due to lower financing costs) leading to higher profit margins. This idea also points the way to investing in other sectors that benefit from lower rates; real estate, auto, banking, bonds, and even income securities (as bond rates fall, the dividend yield on income securities becomes more attractive, helping to push up their price).

Finally, we are moving past the stage where growth is the focus of stock selection. Moving forward, the average valuation of stocks is quite comprehensive… and many of the large-cap companies are clearly overvalued. This will push investors to look for undervalued stocks to improve their performance.

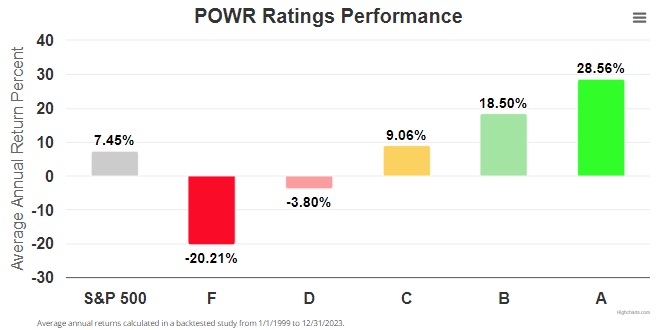

Our big advantage in finding stocks that meet all 3 of these criteria is our proprietary POWR Ratings analysis model, which includes 118 factors for each stock that indicate its likely outperformance in the year ahead.

Yes, past performance is no guarantee of future results, but when you consider the consistent outperformance of POWR Ratings over the past 25 years, it certainly increases your odds of using them as you move forward:

Your eyes do not deceive you. A-rated stocks have outperformed the S&P 500 by nearly 4x since 1999. And that outperformance continues to increase here in 2024.

The downside to this model is that there are approximately 1,300 buy-rated stocks to consider each day. If you want me to narrow it down to my 12 favorites right now, read on below for more details…

What to do next?

Check out my current 12-stock portfolio filled to the brim with the outperformance advantages found in our unique POWR Ratings model. (Nearly 4 times better than the S&P 500 Index dating back to 1999)

This includes 5 recently added hidden small caps with huge upside potential.

I also have 1 specialty ETF that is incredibly well positioned to outperform the market in the weeks and months ahead.

This is all based on my 44 years of investing experience watching bull markets… bear markets… and everything in between.

If you’re curious to learn more and want to see these 13 hand-picked lucky trades, click the link below to get started right away.

Steve Reitmeister’s Trading Plan and Top Picks >

Wishing you a world of successful investing!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO of StockNews.com and editor of Reitmeister Total Return

SPY shares traded Tuesday afternoon at $518.48 per share, down $3.68 (-0.70%). Year to date, SPY has gained 9.42%, compared to a % gain in the benchmark S&P 500 index over the same period.

About the author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. He is not only the CEO of the company, but also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Find out more about Reity’s background, along with links to her most recent articles and headline picks.

Moreover…

The mail Q1 stock summary and future outlook appeared first StockNews.com