Key points

- Quad is a full-service global marketing solutions company with major clients, including Target, American Express, Conagra and General Mills.

- Quad has reduced its net debt by 55%, or $564 million, over the past 4 years, bringing net debt leverage to 2X at the end of 2023.

- Quad reinstated its dividend and repurchased 2.9 million shares in 2023.

- 5 titles we prefer to Quad/Graphics

Quad/Grafica Inc. NYSE: QUAD is a full-service global marketing solutions company for commercial clients in the retail, healthcare, financial services, publishing and consumer packaging industries. With more than 15,000 employees, the industrial products company offers print services that drive mailers, catalogs and publications to data and analytics, creative and content solutions.

Some of Quad’s blue chip customers include American Express Co. New York Stock Exchange: AXP, Target Co. New York Stock Exchange: TGT, Ulta Beauty Inc. NASDAQ:ULTA, General Mills Inc. NYSE:GIS AND Conagra Brands Inc. NYSE:CAG. As the advertising market recovers, Quad should benefit from larger marketing budgets that will further accelerate as interest rates begin to fall, ushering in economic expansion and reducing debt service fees.

On the pulse of consumer behavior

Quad needs to stay ahead of consumer behavior by presenting itself as a global marketing experience (MX) company. They offer in-depth research and data analysis using artificial intelligence (AI) to identify consumer trends and improve marketing campaigns and solutions for their clients. They provide end-to-end marketing solutions from retail insert printing, in-store marketing, brochures and publications to customized print products and promotions to “Inspire Shoppers to Take Your Brand Home”. As they say, they help brands succeed on shelves with must-have designs, media and packaging that jump off the shelves. Quad leverages household data to strengthen audience targeting.

Obtain AI-powered insights on MarketBeat.

Recover with the economy

As the uncertain macroeconomic climate improves, companies strengthen marketing budgets, which strengthens Quad’s earnings. Quad reported fourth-quarter 2023 earnings per share of 23 cents, beating analysts’ estimates by 10 cents. Revenue fell 11% year over year to $787.9 million, still beating estimates of $758.4 million.

Reflecting on the entire year 2023

For full-year 2023, the company reported net losses of $55 million, primarily attributed to restructuring costs, higher interest rates on debt and lower sales. Adjusted EBITDA was $234 million at a margin of 7.9%, compared to a margin of 7.8% in the prior-year period. Quad generated $148 million in net cash from operating activities and free cash flow of $77 million in 2023. The company has reduced net debt by $564 million, or 55%, over the past four years, reaching 2X net debt leverage at the end of 2023.

Forecast for the full year 2024

The company expects full-year 2024 net revenue of $2.69 billion to $2.81 billion, down 5% to 9% from consensus analyst estimates of $2.88 billion. Quad anticipates $60 million in cost savings from plant capacity and labor reduction initiatives in response to adverse external factors, which include significant postage rate increases and economic uncertainty, negatively impacting print volumes.

Check the heat map of the sector on MarketBeat.

CEO Insights

Quad/Graphics CEO Joel Quadracci noted that the company has exceeded its adjusted EBITDA above its expected average threshold for 2023. The company’s adjusted EBITDA margin is consistent despite an 8% decline in net sales annual. Significant increases in postal rates, well above the rate of inflation, and high interest rates in the financial services industry have led to shrinking direct mail budgets. While the company expects a long-term organic decline in large-scale printing, it is treating all costs as variables and is optimizing its print production platform by consolidating work across factories. They are also selling off assets that are no longer needed for operations.

Transition from direct mail to digital campaign success

Quad is aggressively pursuing its growth strategy as an experience marketing (MX) company. This involves providing an integrated service by solving problems and eliminating pain points and sources of friction during the marketing process.

They are helping customers appreciate the branded footwear market Wolverine Worldwide Inc. NYSE: WWW shift to digital campaigns from direct mail to grow and strengthen connections with consumers. Quad testing involved multiple variables in over 1,400 different combinations to derive optimal content and designs that surpass existing content. As a result, Quadracci revealed, “Wolverine got almost double its response rate. With more effective creative and digital messaging, the client also doubled conversion rates, doubled click-through rates and increased sales – an incredible 261% per shopper.”

Quad/Graphics analyst ratings and price targets I’m on MarketBeat. Quad/Graphics competitors and competitor actions can be found with MarketBeat Stock Screener.

Daily mug template

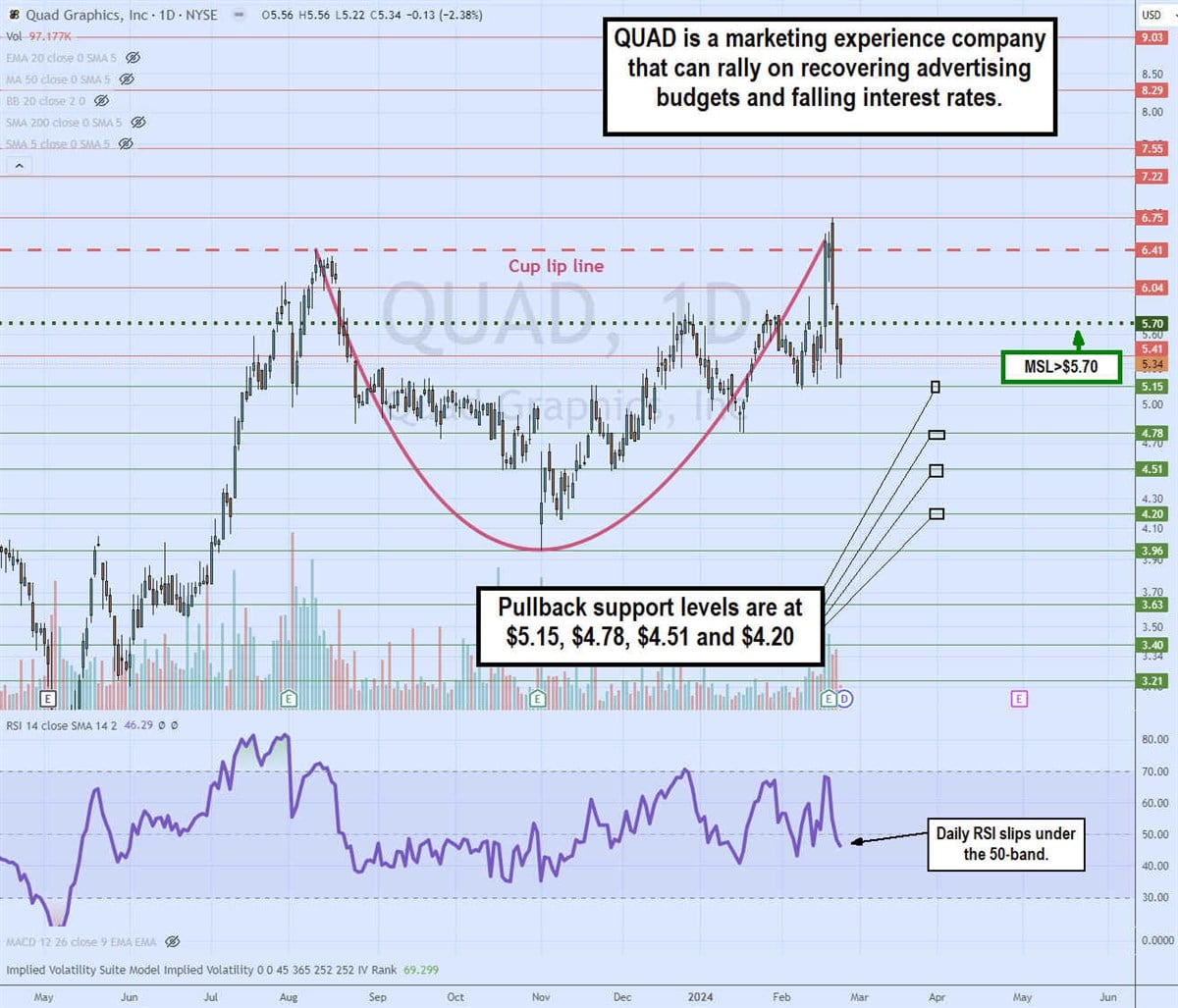

The daily candlestick chart on QUAD illustrates a daily cup pattern. The cup lip line formed at the swing high of $6.41 on August 10, 2023, while it fell to a low of $3.96 on November 1, 2023. QUAD triggered a trough of the daily market structure (MSL ) to $5.70 in its fourth-quarter 2023 earnings release for shares rising through the lip of the cup line, reaching a peak of $6.75 on February 21, 2024, before falling back toward the support level of $5.15.

A breakout on the MSL to $5.70 could initiate handle formation. The daily relative strength index (RSI) peaked at the 70 band and fell below the 50 band, awaiting a further collapse or reversal bounce. The pullback support levels are at $5.15, $4.78, $4.51, and $4.20.

Before you consider Quad/Graphics, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Quad/Graphics wasn’t on the list.

While Quad/Graphics currently has a “buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

Are you looking to generate income with your stock portfolio? Use these ten actions to generate a safe and reliable source of investment income.

Get this free report