pabradyphoto

The New York Fed predicts that the Federal Reserve could halt the outflow of its still-excessive balance sheet – a process popularly known as quantitative tightening – next year.

The 2023 open market operations report comes after Fed policymakers have begun to discuss last month when it will slow the monthly pace of contraction of its asset portfolio, signaled by the Fed it would happen “fairly soon”. The balance sheet reduction has been at a rate of as much as $95 billion per month, but officials are mulling a plan for the QT stopping point to reduce the risk of market stress.

According to the minutes of the latest meeting of the Federal Open Market Committee on March 19-20, “participants generally favored reducing the monthly pace of outflow by about half the recent overall pace.” The Fed’s holding of Treasuries and mortgage-backed securities has retreated by about $1.5 trillion since the runoff began in June 2022.

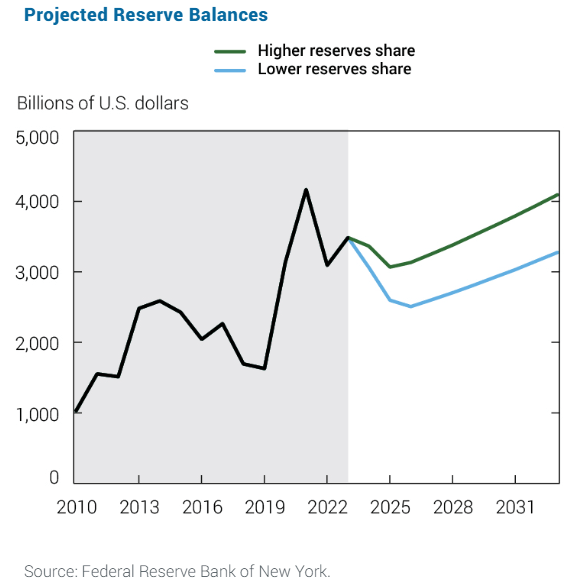

The New York Fed trading desk outlined two scenarios in which QT could end. In a “higher reserves” environment, the outflow could stop in early 2025, with the balance falling to around $6.5 trillion. In the “lower reserves” scenario, QT could stop in mid-2025 with a portfolio of $6 trillion. Reserves are simply funds that depository institutions park at the Fed. Banks are required to hold a certain amount of them to ensure they always have liquidity available in the event of significant deposit outflows.

If the Fed lets reserves decline too much, there is a risk of triggering volatility in the overnight funding market, similar to the dramatic increase in repo rates in September 2019, when the Fed last attempted to reduce the own budget. Instead, excessive reserves drain bank capital, suppress lending activity, and firmly entrench the Fed’s vast presence in the Treasury and repo markets.

However, “future financial and economic conditions and their impact on reserve demand and the balance sheet are highly uncertain,” the report said.

Keep in mind that QT is the opposite of QE (quantitative easing), an asset swap between the Fed and banks whereby the Fed buys Treasury securities in exchange for bank reserves. When the pandemic hit the United States in March 2020, the Fed responded by purchasing excessive amounts of Treasury debt and mortgage-backed securities while pumping reserves into the banking system, thus expanding its balance sheet. Overall, the Fed has three policy tools at its disposal: QT/QE, rate cuts/hikes, and forward guidance (think dot plot).

The New York Fed report also estimates that net income generated by the central bank’s bond holdings could remain negative through 2024, before returning to profitability in subsequent years. Unrealized losses on its bond portfolio last year totaled $948.4 billion, due to the higher cost of the Fed’s interest-bearing liabilities, compared with $1.08 trillion in 2022. The sum of the Fed’s interest expenses Fed in 2023 exceeded its earnings of $114.3 billion (versus net income of $58.8 billion in 2022), it said last month.