EschCollection/DigitalVision via Getty Images

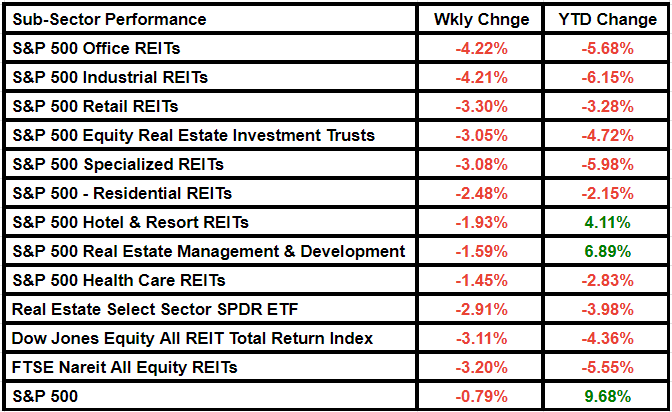

The SPDR Fund Real Estate Select Sector ETF (NYSEARCA:XLRE), which tracks real estate stocks in the S&P 500 index, fell ~3% this week, as markets priced in diminished hopes of a short-term rate cut.

The Dow Jones Equity All REIT Total Return Index was down there 3.11%while FTSE Nareit All Equity REITs fell by 3.20%.

Federal Reserve Chair Jerome Powell reiterated Wednesday that he doesn’t expect it will be appropriate to lower the benchmark rate until there is greater confidence that inflation is moving sustainably downward toward 2%.

Meanwhile, Fed Governor Michelle Bowman said on Friday that it was possible that the US central bank would be forced to raise interest rates further.

Analysts at Citi Research rated the real estate sector as a market weight, noting that valuation indicators are compelling, but the fundamental framework continues to face challenges in 2024.

Likewise, the broader S&P 500 had its worst week of 2024, posting losses in three out of five sessions.

Separately, a federal appeals court ruled that the U.S. Justice Department can reopen its antitrust investigation into the policies of the National Association of Realtors, barring the real estate group from imposing a settlement in 2020 to settle the case. The proposed agreement aimed to increase transparency on broker commissions, among many other requirements for the NAR.

The Real Estate Management & Development subsector of the S&P 500 Index, which continued to post gains throughout the year, saw a decline of 1.59% this week.

Office REITs were the biggest losers, having lost 4.22% of their total value. Industrial REITs follow with a decline of 4.21%.

Boston Properties (BXP), Kimco Realty (KIM), and Equinix (EQIX) were laggards on the S&P 500. Kimco was downgraded based on lower growth from its acquisition of RPT Realty. Power REIT (PW) and Sachem Capital (SACH) were other major real estate losers.

According to data solutions provider VettaFi, XLRE recorded net outflows of $41.73 million this week, compared to inflows of $7.32 million last week.

Seeking Alpha’s Quant Rating system changed the fund’s rating to Sell from Hold, focusing on momentum. The rating system downgraded Invitation Homes (INVH) and UDR (UDR), but upgraded Healthpeak Properties (DOC).

SA analysts continue to rate the ETF as Hold.

Here’s a look at the performance of the XLRE subsector: