It’s easy to ignore bad news when the S&P 500 (SPY) is hitting new highs and our net worth is rising. Unfortunately it is often at these heights that the first signs of problems appear… but they are difficult to see at first. That’s why you need to read the latest insights from veteran investor Steve Reitmeister, as he points out a disconnect between fundamentals and current stock price movement. He continues reading below for more information.

Thursday’s better-than-expected PCE inflation report led to another rally pushing the S&P 500 (SPY) towards highs at 5,100. This represents a hearty 5% return in February. Even better, market breadth has improved with smaller stocks arriving in the final days of the month.

I hate to be the bearer of bad news… but unfortunately the fundamentals don’t fully support this rampant bullishness. Mainly because I don’t think things will get much better even after the Fed finally starts lowering rates.

Why?

And what will this mean for stocks in the coming weeks?

Get the answers below with my updated outlook and trading plan.

Comment on the market

In my comment earlier this week I shared the following insight:

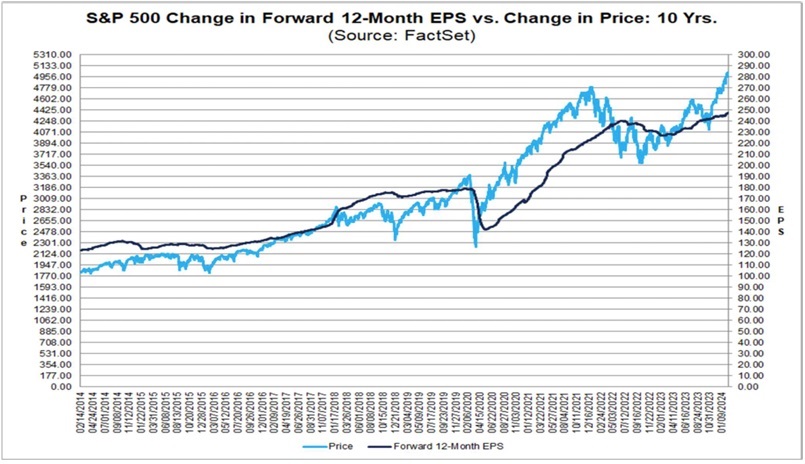

We need to start the conversation with this provocative chart from FactSet comparing the movement of forward S&P 500 EPS estimates versus the stock index:

You will find that for most of the last 10 years the dark earnings line is above the price action. This means that the improving earnings outlook has pushed stocks higher. However, every time we find the stock index rising above the EPS outlook, it reverts back to its 2022 size.

If the lessons of history are true, then they point to 2 possible outcomes.

First, there would be a correction for stock prices to be more in line with the true state of the earnings outlook. Something on the order of 10% should work, with some of the more inflated stocks taking a stiffer penalty of 20%+.

On the other hand, stocks may stabilize for a while, patiently waiting for rates to be lowered. This act is a known catalyst for higher economic growth which should finally push earnings higher bringing things back into balance with the index price.

Yes, there is a 3 of themrd case in which stocks continue to rise because investors are not entirely rational. Unfortunately, those periods of irrational exuberance led to much more painful corrections later in time. So let’s hope that’s not the case in this case too.

(End of previous comment)

However, here’s what I left out of that conversation that needs to be added now. Even when the Fed finally begins to lower rates, it may not be as effective a catalyst for earnings growth and stock price appreciation as investors currently believe.

Let’s just consider what is happening now. GDP is hovering around normal levels, yet earnings growth is lower or even non-existent year after year….Why?

Because difficult times, such as a recession, lead to more rigorous cost cutting by company management. This lower cost base corresponds to improved profit margins and higher growth when the economy expands again. And yes, this is the main catalyst for rising stock prices.

But make no mistake… we didn’t have a recession. And unemployment remains strong. And so, there never was the cost-cutting phase that ushers in the next cycle of impressive earnings growth that drives stock prices higher.

Or to put it another way, even when the Fed lowers rates… it could have a very modest impact on improving earnings growth because of what I just pointed out above. And that equates to less reason for stocks to rise further.

No…this is not the same as another bear market forming. As previously noted, perhaps a fix is in sight. Or more likely that the overall market will remain around current levels with a rotation from growth stocks towards value stocks.

This is where we can leverage our advantage with POWR Ratings.

Yes, it looks at 118 factors in total for each stock, identifying those with the greatest upside potential. 31 of these factors fall into the Value field (the rest are distributed across growth, momentum, quality, safety and sentiment).

This value bias helps POWR valuations every year leading to an average annual return of +28.56% per year since 1999. This year we may be able to leverage our advantage even further as the growth outlook softens and the search for value becomes central. stage.

Read on in the next section to discover my favorite POWR-rated value stocks to add to your portfolio right now…

What to do next?

Check out my current 12-stock portfolio filled to the brim with the outperformance advantages found in our unique POWR Ratings model. (Nearly 4 times better than the S&P 500 Index dating back to 1999)

This includes 5 recently added hidden small caps with huge upside potential.

I also have 1 specialty ETF that is incredibly well positioned to outperform the market in the weeks and months ahead.

This is all based on my 43 years of investing experience watching bull markets… bear markets… and everything in between.

If you’re curious to learn more and want to see these 13 hand-picked lucky trades, click the link below to get started right away.

Steve Reitmeister’s Trading Plan and Top Picks >

Wishing you a world of successful investing!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO of StockNews.com and editor of Reitmeister Total Return

SPY shares traded at $512.85 per share on Friday afternoon, up $4.77 (+0.94%). Year to date, SPY has gained 7.90%, compared to a % gain in the benchmark S&P 500 index over the same period.

About the author: Steve Reitmeister

Steve is better known to StockNews audiences as “Reity.” He is not only the CEO of the company, but also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Find out more about Reity’s background, along with links to her most recent articles and headline picks.

Moreover…

The mail Stock Investors: Why are you so bullish??? appeared first StockNews.com