By Howard Schneider

WASHINGTON (Reuters) – Positive U.S. inflation data has put the Federal Reserve’s debate over an initial interest rate cut on a potential collision course with the presidential election timetable, even as a parade of top economists calling they observe the Fed predict that the Fed will not. make its move until Americans go to the polls.

Rate futures markets now show that investors see a first rate cut as very likely to happen at the Fed meeting on September 17-18, after data showed inflation through the entire first quarter of 2024 was stricter than expected and had clearly slowed progress in bringing it back to lower levels. Fed target of 2%.

A rate cut therefore – just seven weeks before Election Day – would put the spotlight on the Fed, which is doing everything it can to stay out of the political fray. However, not cutting by that date will not necessarily dim that light.

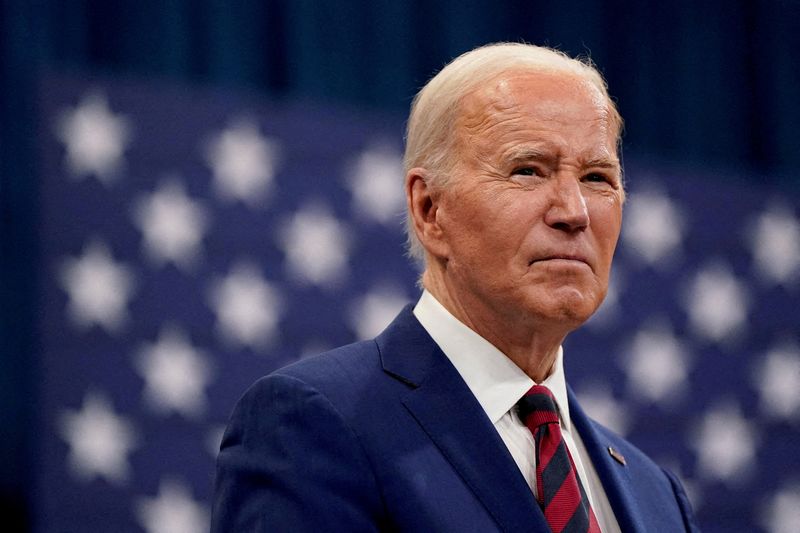

Fed officials are adamant that their policy decisions are completely divorced from political concerns or influences — whether it’s incumbent President Joe Biden’s hope for a soft landing with low inflation and low unemployment to carry into the heart of election season this fall, or a presumptive Republican nominee – and former president – Donald Trump’s argument that if the Fed cuts rates it will only be to help his Democratic rival.

No Fed official offered a potential start date, but policymakers’ projections last month indicated, overall, that they still expected three quarter-percentage-point rate cuts this year, a prospect presented for the first time last December.

With this guidance, investors had for months agreed to a first cut in June, with the other two cuts being staggered over the rest of the year. It was a calendar that seemed well structured around the hottest moments of the presidential campaign, but which was discarded this week when March consumer price index data extended an unexpectedly strong streak, bringing a growing number of Fed officials saying there would likely be no near-term movement on rates.

At the same time, a core of professional Fed watchers now see an outcome in which the Fed loses the presidential election cycle entirely, although that doesn’t mean the central bank won’t be at the center of the campaign.

In the hours after the March inflation data arrived, analysts at JP Morgan, Bank of America, Jefferies, Deutsche Bank and others tore up their earlier predictions that rate cuts would be well underway by the election – a possible advantage for Biden – and some have postponed them to the end of the year or even 2025.

“We do not think the Fed will gain the confidence to start cutting rates before December,” Bank of America economists wrote, meaning Biden would campaign against the stigma of both higher borrowing costs and the persistent inflation.

Biden, for his part, has said he believes the Fed’s baseline predictions for rate cuts this year will prove correct, although recent data has cast doubt on that.

“We don’t know for sure what the Fed will do,” Biden said after Wednesday’s inflation report, but “I stand by my forecast that there will be a rate cut before the end of the year.”