Justin Paget

According to a study by the Federal Reserve Bank of Dallas, housing affordability in the United States would have worsened if the Federal Reserve had not raised interest rates in 2022 and 2023 because home prices would have risen more.

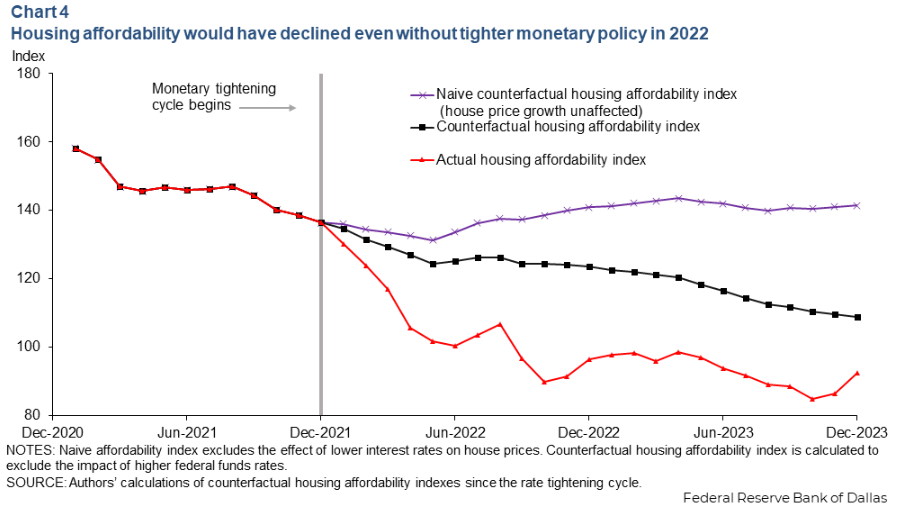

From In March 2022, as the central bank began its most aggressive tightening cycle in decades to reduce inflation, housing affordability worsened significantly as rising mortgage payments dealt a severe blow to potential home buyers. Specifically, the National Association of Realtors’ housing affordability index has fallen nearly 30% since December 2021, the Dallas Fed paper noted, noting levels last seen in the late 1980s.

Keep in mind, however, that many homeowners have been largely unaffected by the current high mortgage rates. In fact, the average homeowner paid a rate of just 3.9% as of September 2023. This is much lower than the average 30-year fixed rate mortgage of 6.82% as of April 4, 2024. Importantly, “ the fraction of homebuyers is small compared to the population of homeowners,” the study says.

Home prices have also seen a sharp rise amid tight supply, even as new listings have started to increase and home price growth is returning to prepandemic levels. When looking at previous real estate cycles, by comparison, home prices typically decline when interest rates rise due to a greater lack of demand.

Home building companies (ITBs) have generally responded to the housing affordability issue by cutting prices or offering mortgage rate reductions. Sure, that resulted in lower margins, but single-family home builders had some breathing room after earning strong profit margins during the pandemic housing boom.

Dallas Fed researchers Alexander Richter and Xiaoqing Zhou noted that home prices have risen so sharply in the postpandemic era “that housing affordability would have declined even if mortgage rates remained at their average ”.

The chart below shows that Fed rate hikes worsen housing affordability. However, excluding fare increases, affordability would still be declining after 2022 (black line). The purple line excludes the impact of lower interest rates on house prices. The red line is the actual housing affordability index.

“When monetary policy is looser, mortgage rates tend to fall, while home prices tend to rise due to greater demand,” the authors wrote. Interestingly, “these opposing channels mean that the net effect on affordability is ambiguous and potentially the opposite of what intuition based solely on mortgage rates would suggest.”

Real Estate Brokerage Stocks: Anywhere Real Estate (HOUS), Re/Max Holdings (RMAX), Redfin (RDFN), Zillow (Z) (ZG), Compass (COMP), Opendoor Technologies (OPEN), Offerpad Solutions (OPAD), eXp World Holdings (EXPI).