After listening to President Joe Biden or looking at polls of the general public, you might think that this weekend’s federal income tax filing deadline is a holiday for America’s wealthiest residents.

And, more to the point, one might get the impression that solving the country’s fiscal problems is as easy as raising taxes.

Neither is true. In fact, the wealthiest Americans are now paying a higher share of federal taxes than at any time in the past 40 years.

However, the persistent gap between what Americans (including the current occupant of the White House) believe about the federal tax code and the reality of who bears most of the burden is a problem. This confuses the debate over how to address chronic budget deficits and how to best manage the insolvency of Social Security and Medicare. More generally, it contributes to a false sense of class warfare that fuels populist politicians of all stripes.

Biden, who has historically been more of a centrist, has leaned more into that message since becoming president. A common refrain in his speeches is the claim that American billionaires pay an average tax rate of just 8%. The Washington PostGlenn Kessler was completely proven wrong earlier this year. There are also more general statements, such as Biden’s promise in last month’s State of the Union address to “protect and strengthen Social Security and make the rich pay their fair share.”

Polls confirm a similar point of view. A recent Morning Consult/Bloomberg poll of voters in seven swing states found that 69% favored raising taxes on Americans earning more than $400,000 a year — a somewhat arbitrary threshold, but one that Biden used as a yardstick for determining wealth. Meanwhile, a Pew Research Center poll conducted last year found that 82% of Americans are bothered “some” or “most” by the feeling that the wealthy are not paying their fair share in federal taxes.

Other surveys show that many Americans have a low level of tax literacy. A recent survey conducted by the Tax Foundation found that “most Americans are not only dissatisfied with the current tax code, they don’t understand it.” One commonly misunderstood aspect is how much the wealthiest Americans pay in taxes each year. In the Tax Foundation survey, 78% of respondents did not know the share of taxes paid by the richest 1% of Americans, but, significantly, 65% of respondents said their taxes were too high.

The simplest conclusion here is hardly surprising. Americans want someone else, preferably someone richer, to pay the costs of government.

Here’s the good news: it’s already happening!

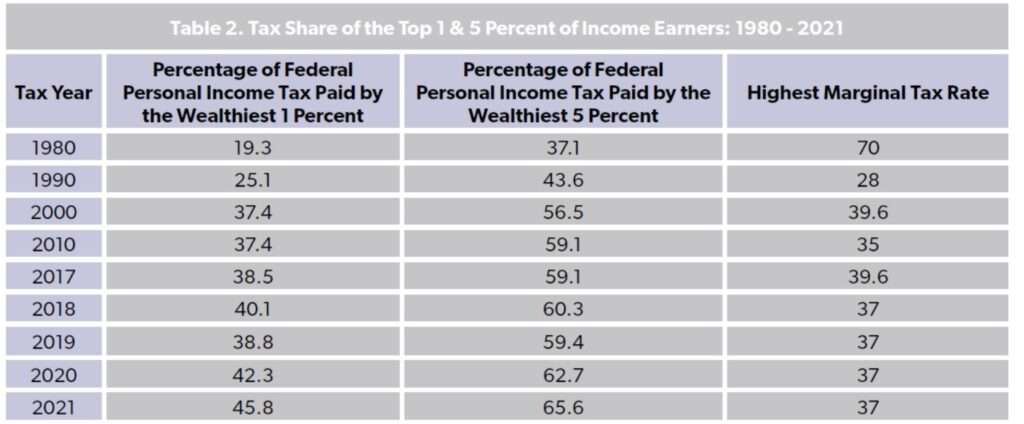

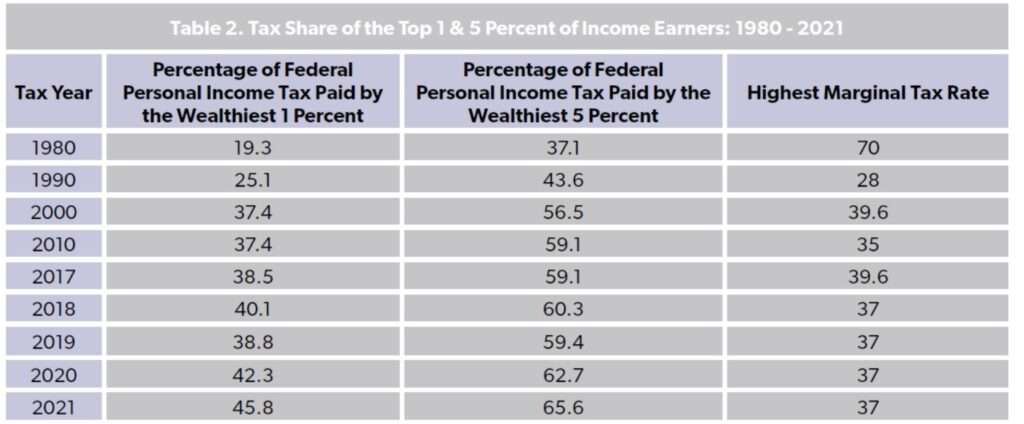

“The top 1% of earners, defined as those with incomes above $682,577, paid nearly 46% of all income taxes” in 2021, according to federal tax data compiled by the National Taxpayers Union Foundation (NTUF ), which advocates lower taxes. This is the highest percentage of taxes paid by the top 1% of earners in any year since 1980.

Other wealthier Americans also contribute heavily. “The top 10 percent of earners were responsible for 76 percent of all income taxes paid, and the top 25 percent paid 89 percent of all income taxes,” the NTUF report found. Meanwhile, the bottom 50% of earners paid just 2.3% in federal income taxes in 2021.

The sense that the rich aren’t paying as much these days may stem from the fact that top marginal tax rates have steadily declined in recent decades. In 1980 the highest federal income tax bracket was 70%, but today it requires 37% for those lucky enough to qualify for it. Despite this, the tax code has become much more progressive over the same period. The top 1% of earners paid less than 20% of all income taxes in 1980, and today it is well more than double that amount.

“Over the past few decades, the share of income taxes falling to the lowest earners has steadily declined as the burden has been increasingly shifted to the wealthiest,” writes Demian Brady, vice president of research at NTUF. “On the other end of the spectrum, our highly progressive tax code ensures that low-income workers are afforded income tax protection through exemptions, deductions and credits.”

The gap between perception and reality in the federal tax code has important implications for some big decisions federal policymakers will have to make in the near future. The first of these big decisions will come next year, when many of the provisions of the Tax Cuts and Jobs Act of 2017 expire. Among other things, Congress and the winner of this year’s presidential election will have to decide whether to allow tax rates personal income tax to return to pre-2017 levels.

Then there is the question of impending Social Security insolvency. The Age Entitlement Program is projected to run a deficit of $2.8 trillion over the next decade. Since both Biden and former President Donald Trump are steadfast in their refusal to touch Social Security benefits, raising taxes is likely to be part of the preferred policy solution. As this idea begins to gain traction, keep in mind that American workers are already “poised to fund $164 trillion in Social Security and Medicare benefits for seniors” over the next three decades, as Brian Riedl of the Manhattan Institute pointed out in a analysis published this week. Raising taxes to protect rights means asking young Americans to pay an even higher bill.

None of these decisions will be free of painful trade-offs, but without a better understanding of the burdens of the current tax code, many Americans will not be able to appreciate those trade-offs. Demagogy about taxing the rich may yield a political payoff in the short term, but it has created a political culture less equipped to address the serious questions about who should pay what to cover the annual cost of our $7 trillion. and growing) federal government.

The wealthy are already paying record levels in federal taxes. How much more will be enough?