A change in strategy has helped transform the GoodHaven fund from a long-term underperformer to an outperformer since late 2019. The fund follows a concentrated value approach and now has a four-star (out of five) rating in Morningstar’s Large Blend. fund category.

Larry Pitkowsky, managing partner of GoodHaven Capital Management, based in Millburn, NJ, explained how this was accomplished in an interview with MarketWatch.

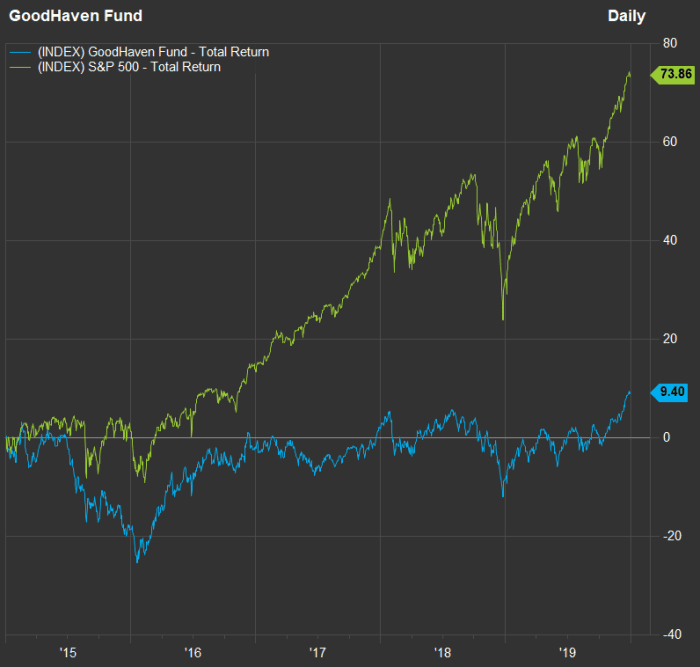

To start, take a look at the GoodHaven Fund’s performance, with dividends and capital gains reinvested, over a five-year period through 2019, compared to the S&P 500:

For five years through 2019, the GoodHaven Fund returned just 9.4%, while the S&P 500 returned 73.9%.

DoneSet

In late 2019, Pitkowsky spearheaded a series of changes in how the fund operated, including paying less attention to macroeconomic factors, acting more quickly if investments aren’t performing well, and holding on to successful companies longer, to avoid selling too early. He cited Microsoft Corp. MSFT

as an example of a stock he had parted with too early, and said that an example of an industrial and macro-based investment that didn’t do well was a group of energy and materials stocks that got crushed when commodity prices commodities fell from mid-2014 and 2015 until early 2016.

“We like to own high-return-on-equity companies” with good growth trajectories, Pitkowsky said, “before everyone else realizes it.”

He added: “We try to avoid structurally challenged businesses that might be statistically cheap.”

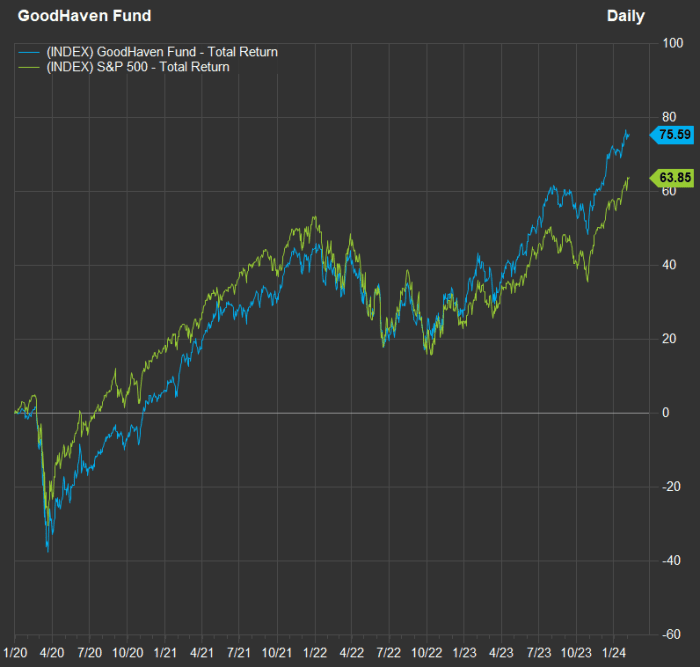

Now let’s take a look at the fund’s performance compared to the S&P 500 Index

since the end of 2019:

The GoodHaven Fund has outperformed the S&P 500 Index since it changed its investment selection process in late 2019.

DoneSet

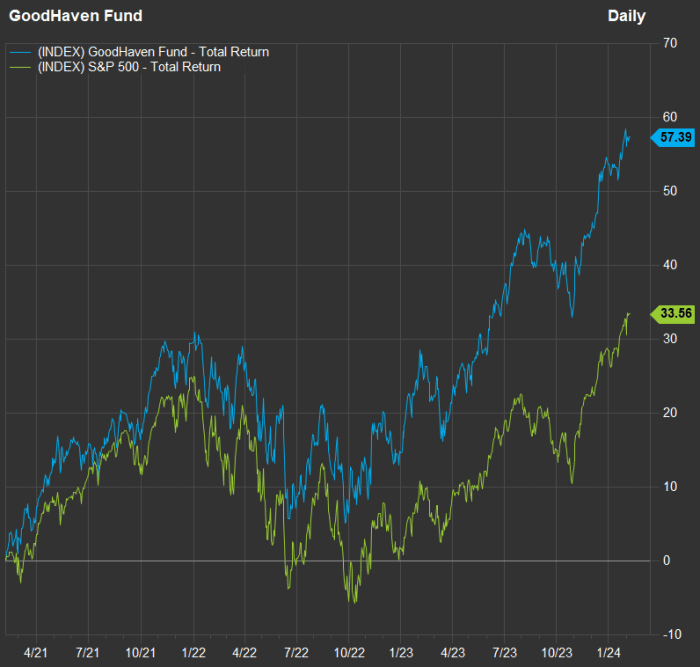

Narrowing further to a three-year chart through February 6 sheds more light on the mixed performance of the stock market overall, with an 18.1% decline for the S&P 500 in 2022 followed by a 26.3% return in 2023.

The GoodHaven Fund has had a smoother run through the stock market’s up-and-down cycle over the past two years, leading to a much higher three-year return than the S&P 500.

DoneSet

Fund holdings and comments on companies

GoodHaven Capital Management has approximately $340 million in assets under management, including separate client accounts, and approximately $230 million in the fund.

As of Nov. 30, the fund’s portfolio was 29% cash and short-term investments, partly due to an influx of new money from investors but also because Pitkowsky wants to keep cash readily available to make short-term purchases. attractive prices and to satisfy any redemption requests from the fund’s shareholders. At times the fund’s level of liquidity and short-term investments was much lower.

Here are the fund’s top 10 stock holdings as of November 30, making up 52% of its portfolio:

| Action | Ticker | % of the fund | P/E ahead |

|

Berkshire Hathaway Inc. Class B |

BRK |

11.2% |

22.0 |

|

Alphabet Inc. Class C |

GOOG |

7.0% |

21.1 |

|

Manufacturers FirstSource Inc. |

BLDR |

6.6% |

14.6 |

|

Bank of America Corp. |

BAC |

5.4% |

10.3 |

|

Devon Energy Corp. |

DVN |

4.4% |

7.6 |

|

Jefferies Financial Group Inc. |

JEF |

4.2% |

11.1 |

|

Exor NV |

NL: EXO |

4.2% |

7.6 |

|

Lennar Corp. Class B |

LENGTH |

3.5% |

9.6 |

|

Progressive body |

PGR |

2.8% |

21.00 |

|

KKR & Co. |

KKR |

2.8% |

18.5 |

|

Sources: GoodHaven Capital Management, FactSet |

|||

Click on the tickers for more information on each company, fund or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on MarketWatch’s stock quotes page.

The table includes forward P/E ratios for stocks, based on Tuesday’s closing price and consensus earnings per share estimates for the next 12 months among analysts surveyed by FactSet. For comparison, the S&P 500 trades at a weighted forward P/E of 20.2.

Two “big wins” cited by Pitkowsky in discussing the GoodHaven fund’s recent outperformance were Builders FirstSource Inc. BLDR

and Class B shares of Lennar Corp. LEN,

a homebuilder that trades at a low P/E, along with its entire industry group. We listed P/E ratios for 17 homebuilders in October, when most of them were very low. At the time, the S&P Composite 1500 housing subsector was trading at a weighted forward P/E of 7.6. The group now trades on a forward P/E of 10.2.

Pitkowsky believes both Builders FirstSource and Lennar have “a lot of growth ahead of them” and is also pleased that both companies have low debt levels. “The big builders have become much better companies,” he said.

Something else to consider is that Pitkowsky holds Class B shares of Lennar, which trade at a forward P/E of 9.6 – a discount to the valuation of LEN’s Class A shares,

which trade at a forward P/E of 10.3.

Lennar’s Class B shares have 10 times the voting rights of Class A shares, but trade at a lower P/E, likely because they are less liquid and not included in the S&P 500, Pitkowsky said. “When we started researching [Lennar]we have seen supervoting stocks trading at about a 20% discount to non-supervoting stocks,” he said, adding that the fund benefited from the narrowing valuation gap.

Another big winner for the fund was Bank of America Corp., which Pitkowsky said was its biggest purchase during the 12-month period ending Nov. 30. Bank of America now trades at a forward P/E of 10.3, compared to a five-year average of 11.1 and 10-year average of 11.3.

“[Bank of America’s] the return on equity is over 11%,” he wrote in the November letter to GoodHaven Fund shareholders. But he likes the stock’s risk/reward potential for several reasons, including “recurring earnings from non-banking businesses.”

While lamenting what he now knows is an early sell-off of Microsoft stock, Pitkowky points to Alphabet Inc. GOOGL

GOOG

as a strong participation to which he has remained faithful since 2011.

Alphabet trades at the lowest P/E among the 10 largest companies in the S&P 500 Index.

Pitkowsky said he feels comfortable with Alphabet as a large holding company, in part because the company has “focused more over the last couple of years on redesigning the cost base.” He added that the stock’s valuation “does not appear challenging” compared to Alphabet’s further growth potential.

Not to be missed: Is Meta now a value stock?