A handful of mega-cap tech names have been responsible for most of the S&P 500’s gains over the past year, but that has started to change in 2024, according to Bespoke Investment Group.

While the so-called Magnificent Seven stocks, a group of top-performing technology companies that includes chipmaker Nvidia Corp. NVDA,

– have continued to lead the S&P 500’s SPX rally since early 2024, data indicates the rest of the market has started to catch up. More than 60% of stocks in the benchmark large-cap index have posted year-to-date gains, a sign that stock market breadth has finally improved, Bespoke analysts said in a client note viewed by MarketWatch on Tuesday.

Another signal of strong breadth is seen in the percentage of stocks that hit 52-week highs. On Monday, 106 members of the S&P 500, or 21.2% of stocks in the index, hit new 52-week intraday highs. According to market data from Dow Jones, it was the highest daily value since May 10, 2021.

Meanwhile, the S&P 500 on Monday extended its streak of sessions, when more stocks in the index hit 52-week highs than 52-week lows, to 85 trading days, according to data from Bespoke.

Reaching a 52-week high is often considered a significant bullish signal in the stock market as it can indicate positive momentum or strong investor confidence, while also suggesting that the price of the underlying stock has risen steadily over the past year.

See: US stocks are starting the year off to their best start since 2019, and the rally isn’t just about the ‘magnificent seven’

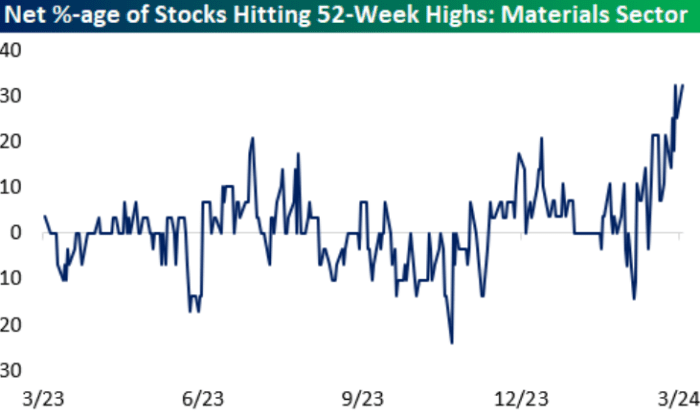

When looking at the individual sectors driving these new highs, the S&P 500 Industrials XX:SP500.20 and Materials XX:SP500.15 sectors have seen a “steady broadening” in the number of stocks hitting 52-week highs so far in 2024.

On Monday, 42% of industrial sector stocks and 30% of materials sector stocks traded at their highest levels in at least a year, Bespoke analysts noted (see charts below).

SOURCE: TAILOR INVESTMENT GROUP

SOURCE: TAILOR INVESTMENT GROUP

The industrials and materials sectors each outpaced the information technology sector by less than 1% last month, according to FactSet data. The two cyclical sectors continued to outperform technology stocks in March and are up 0.3% and 1.1% respectively from this month, compared to declines of 2.1%, 1.6% and 0.7 % for consumer discretionary goods XX:SP500.25,

the XX:SP500.50 communications services and XX:SP500.45 information technology sectors, respectively, over the same period, according to FactSet data.

The seemingly unstoppable rally in “Magnificent Seven” stocks has led some investors to express concern about the market’s intense concentration, but there are signs that this group of stocks is finally starting to pass the baton, analysts at Bespoke said.

While nearly 30% of computer stocks in the S&P 500 index hit 52-week highs on Monday, the figure was lower than Friday’s 34% level.

Meanwhile, only 23% of consumer discretionary stocks posted new highs on Monday. According to data compiled by Bespoke, that number was also lower than the percentage of new highs the industry reached in mid-December.

U.S. stocks fell Tuesday afternoon, as technology stocks struggled after a rally that sparked concern about their lofty valuations last week. According to FactSet data, the S&P 500 fell 0.9%, to 5,085 points, while the Nasdaq Composite COMP fell 1.7% and the Dow Jones Industrial Average DJIA fell 0.8%.