Scams

The Internet can be a wonderful place. But it’s also full of scammers who target people at risk of fraud.

06 March 2024

•

,

5 minutes. Light

We are all getting older. This is good news for digital scammers, who see big profits in a rapidly aging society. They are increasingly targeting seniors because they suspect these targets have more money to steal, but potentially fewer digital savvy to spot the early warning signs of a scam. In 2022, those 60 and older reported $3.1 billion in cybercrime losses to the FBI, resulting from 88,262 incidents. While this represents an 82% year-on-year increase, not many more cases will have been reported.

The impact of such scams can be devastating if you are already retired and have no source of income to replace the savings lost to scammers. So, if you are a senior or a concerned relative, read on.

10 scams to watch out for

The Internet can, of course, be a wonderful place. But it is also full of bad people trying to steal your personal information and money. Here are some of the most common patterns:

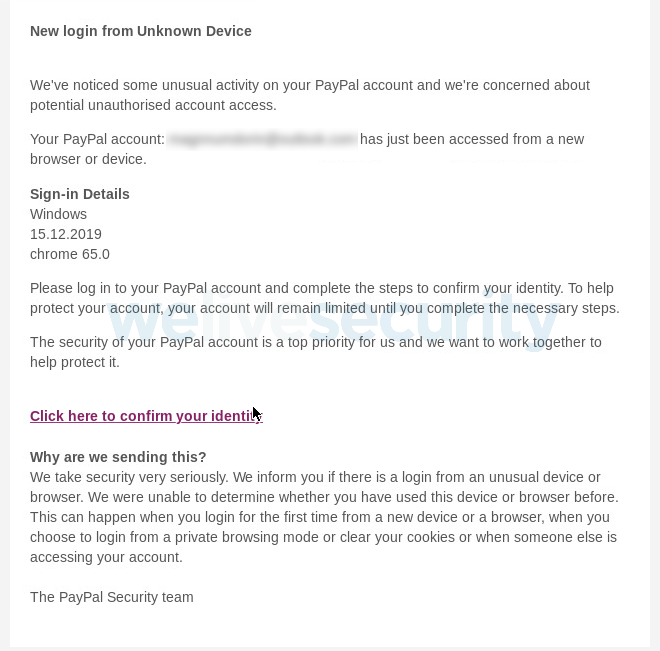

1. Phishing

Let’s start with a threat that is a plague on the modern Internet: phishing. A phishing email or phone/social media message will arrive unsolicited. The scammer impersonates a legitimate entity and asks you to provide information such as account login or click on a link/open an attachment. The former could allow them to take control of your accounts, while the latter could trigger a malware download designed to steal more data or lock your computer.

2. Romance scams

Romance scams earned scammers $734 billion in 2022, the FBI says. Scammers will create fake profiles on dating sites, befriend lonely hearts and build a relationship, with the aim of extracting as much money as possible. Typical stories are that they need money for medical expenses or to travel to see their significant other. It goes without saying that they will always find an excuse not to show up for a video call or not to meet in person.

3. Medicare/Healthcare

The scammer impersonates a Medicare representative with the goal of obtaining personal and medical information that can be sold to others to commit health insurance fraud. They can do this via email, phone, or even in person.

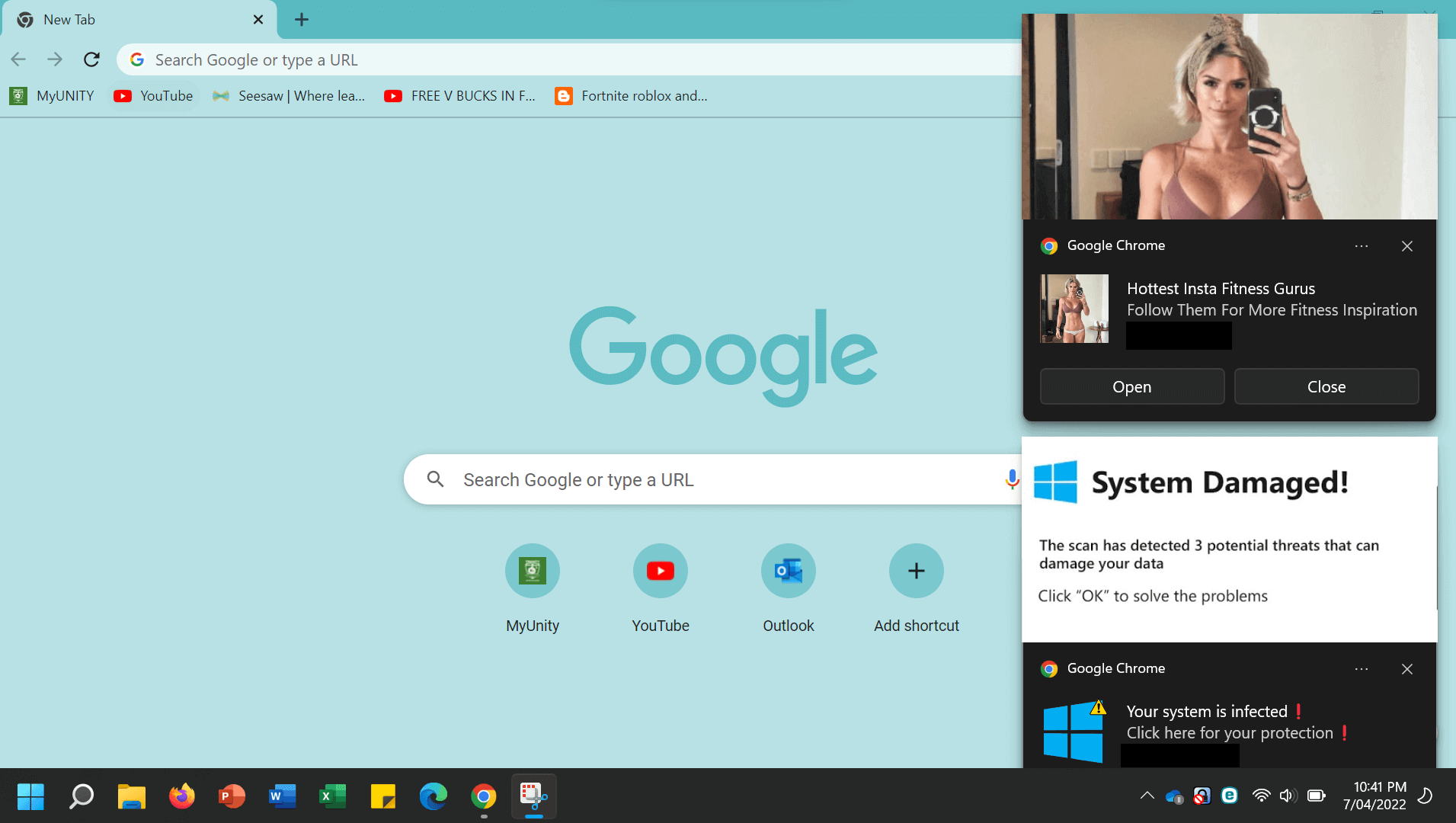

4. Technical support

In one of the oldest phone scams, the scammer impersonates a legitimate entity such as a technology company or telecommunications provider, telling you that there is something wrong with your PC. This may happen suddenly, or you may be required to call a “helpline” after a harmless but worrying pop-up appears on your computer. The scammer may trick you into giving them access to the machine. They will try to find a way to earn money from you; for unnecessary “protection” or “updates” of the machine or for the theft of financial information from the machine.

5. Fraud in online purchases

Scammers set up legitimate-looking online stores and then trick users into visiting them via phishing emails, SMS or unsolicited social media messages. Items are often discounted with incredible offers. However, the products are counterfeit, stolen or non-existent and the real goal is to steal your card details.

6. Robocalls

Robocalls rely on automated technology to annoyingly call large numbers of recipients at once. A pre-recorded message can be used to offer free or heavily discounted goods. Or it could be used to scare the recipient into responding, for example by telling them that they are the subject of an impending lawsuit. If you respond, scammers will try to get your personal and financial information.

7. Government impersonation

Like tech support scams, these are usually run by call centers based in South Asia. Combined losses topped $1 billion in 2022. In this version, the scammer will call pretending to be from the IRS, Medicare, or another government agency asking for unpaid taxes or other payments. They will aggressively warn that failure to pay could lead to arrest or other sanctions.

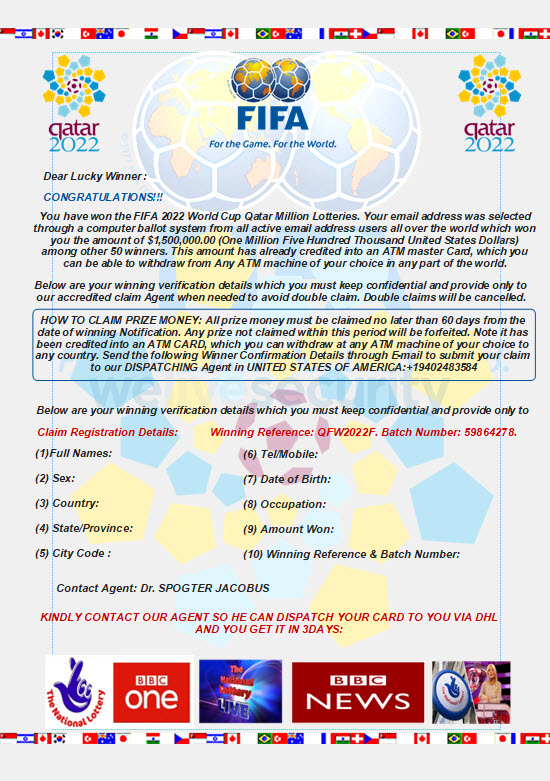

8. Lottery scams

A scammer calls you out of the blue claiming that you have won a lottery and all you have to do to recover your winnings is send a small processing fee or tax up front. Of course there is no prize and your money will disappear.

9. Grandparent scam

A scammer calls you without warning pretending to be a relative in distress. They usually start by saying something like “Hi grandma, do you know who this is?” and then proceed with a tale of woe designed to convince you to part with money to help them. They usually require a money transfer, gift cards, or payment via a cash app. They may ask you to keep everything secret. In some variations on this theme, the scammer pretends to be a police officer, doctor, or lawyer attempting to arrest and try to help the grandchild. Advances in artificial intelligence software known as deepfakes may even allow them to imitate your grandchild’s voice more accurately to perpetrate what are called “virtual kidnapping scams.”

10. Investment scams

This category, which represents the highest source of income for cybercriminals in 2022, earning over $3.3 billion, refers to get-rich-quick schemes that promise low risks and guaranteed returns, often through investments in cryptocurrencies . In fact, the entire project is built on sand.

How to stay safe

We’ve talked about this before, and while scammers’ tactics may change, best practice advice remains pretty consistent. Remember the following to stay safe:

- If an offer is too good to be true, it usually is.

- Treat any unsolicited contact with suspicion. If you want to reply, never reply directly to a message. Instead, Google the sending institution and call or email separately to confirm.

- Stay calm, even when being harangued on the phone. And don’t provide any personal information.

- Don’t trust caller ID because it can be spoofed.

- Use multi-factor authentication on your accounts to mitigate the threat of someone stealing your logins.

- Never send money via bank transfer, payment apps, gift cards or cryptocurrency, as there is no way to request it back in case of fraud.

- Don’t click on links or open attachments in emails/SMS/social media messages.

What to do if you have been scammed

If you believe you have been scammed, contact your local police, your local bank (if financial details are involved), or even (in the US) Adult Protective Services. It’s also a good idea to reset your passwords if you’ve given them to a potential scammer. In the United States, consider reporting the case to the FTC.

If you read this article and have elderly relatives who worry you, take the time to talk about the most common scams. Technology can often be intimidating if we don’t fully understand it. But it is precisely this reluctance to know more – and our reluctance to tell anyone they have been scammed – that scammers take advantage of. Let’s not let them have the last laugh.