An individual retirement account, or IRA, is a tax-advantaged investment account that allows you to save for retirement on a tax-free or tax-deferred basis, depending on the type of account you have.

With a traditional IRA, you won’t pay taxes on your earnings until you make a withdrawal in retirement, or you can contribute after-tax income with a Roth IRA. Both of these types of accounts can help you fund your retirement, perhaps along with Social Security payments and workplace benefits like a 401(k).

Regardless of which IRA you choose, these accounts can boost your retirement savings and diversify your portfolio. Below we will explain the differences between the two main types of IRAs.

IRA Fast Facts:

-

- Anyone can open an IRA account as long as they have income, even minors.

- There are some exceptions that allow penalty-free early withdrawals of IRA contributions.

- Typically, however, withdrawing income before age 59½ is subject to a 10% tax penalty.

- You can own more than one type of IRA.

- Anyone can open an IRA account as long as they have income, even minors.

- There are some exceptions that allow penalty-free early withdrawals of IRA contributions.

- Typically, however, withdrawing income before age 59½ is subject to a 10% tax penalty.

- You can own more than one type of IRA.

Part of what makes IRAs attractive is that they are simple to set up and offer certain tax advantages. Unlike a 401(k), which requires sponsorship from an employer, you can open an IRA through a bank, broker or automated investment advisor on your own in minutes. There is no age requirement on these accounts, so anyone can open one as long as they have W-2, 1099, or 1040 earnings.

Determining which type of IRA is right for you depends on your income, both now and what you expect to earn in the future. Roth IRAs have an income limit of $161,000 for single filers and $240,000 for married couples filing jointly starting in 2024. If your salary exceeds the limit, you may want to consider a traditional IRA.

According to Alicia Munnell, director of the Center for Retirement Research at Boston College, if you’re eligible for both a Roth and a traditional IRA, you should take a look at your tax expectations going forward to decide the smarter option.

“If you have a high income, a traditional IRA can allow you to defer paying income taxes now and help you save for retirement,” Munnell says. “If you prefer to pay taxes upfront while contributing and not worry about it later, a Roth can be a good investment.”

Traditional IRAs vs. Roth

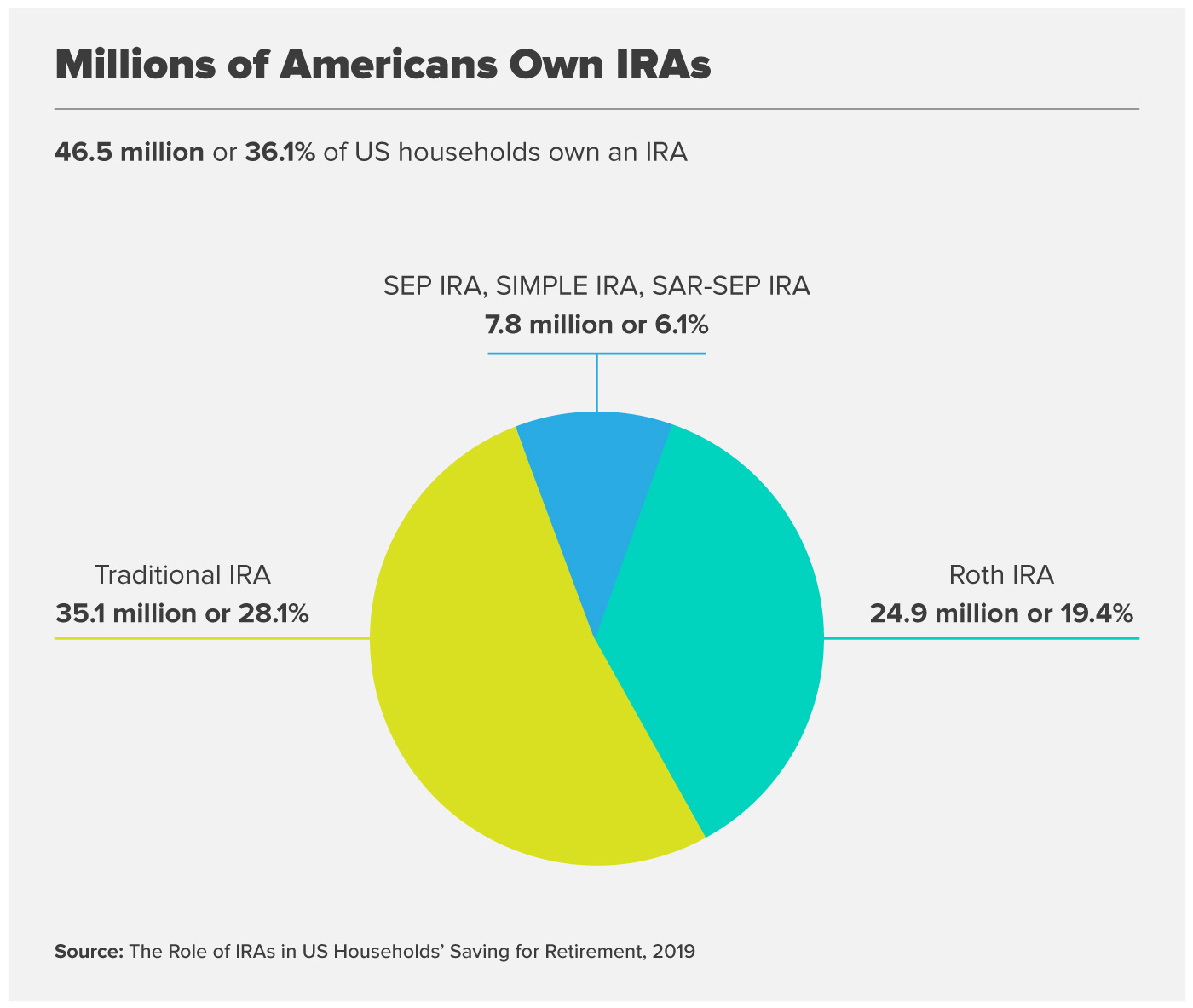

Traditional and Roth IRAs are the most common IRAs. According to the think tank Tax Policy Center, more than 60 million Americans own IRAs in 2020, with the average account balance hovering around $157,000.

One of the main benefits of both traditional and Roth IRAs is that your investments will grow tax-free.

| Traditional IRAs vs. Roth IRAs |

| You can defer paying income tax on your contributions until they are withdrawn from your account. | Your investments are made with after-tax dollars, so once you reach retirement your savings will be tax-free. |

| It has no income limits. | It has an income limit. |

| Required minimum distributions (RMDs) starting at a specific age. The account holder must begin taking RMDs at age 72, or at age 73 if he or she turns age 72 after December 31, 2022. | It has no required minimum distributions (RMDs), meaning you can continue to grow your savings indefinitely. |

| You may be entitled to a tax deduction. | Does not include tax breaks. |

| There is a 10% early withdrawal penalty on distributions before age 59 1/2, unless the money is withdrawn due to an exception such as death, disability, education financing, medical expenses, first home purchase or birth or adoption of a child. | Withdrawals are more flexible. First, you can withdraw contributions at any time without penalty, since you’ve already paid taxes. As for earnings withdrawals, they are tax-free if you have had a Roth IRA for at least five years and are age 59 1/2 (or older). You can also withdraw tax-free at any age if you’ve had a Roth IRA for five years and qualify for certain exceptions, such as buying your first home. |

| Similarities |

| You can farm for tax-free cash. |

| You can open an account regardless of your age, as long as you have earned income. |

| You can contribute up to $7,000 in 2024 ($8,000 if you’re 50 or older), even if you’re also contributing to a 401(k) or other company-sponsored savings account. |

What type of IRA is right for me?

If you’re one of the many people thinking about opening a retirement savings account, it’s important to explore all your options. Opening an IRA is simple, and most people invest in it to take advantage of the tax advantages, which help their money grow faster.

There are a few other types of IRAs besides traditional and Roth, and each has its advantages. Here’s a breakdown of the different IRAs available to consumers:

| Type of IRA | Definition | Contribution limit |

| Traditional IRA | A traditional IRA allows your contributions to grow tax-deferred until you withdraw them in retirement. There are two main types of traditional IRAs: deductible and non-deductible. Your financial situation will determine whether or not you will get a tax deduction on your contribution. Nondeductible IRAs are similar to Roth IRAs in that contributions are made with after-tax dollars, but they differ from them in that contributions are not limited by how much you earn. |

For 2024, total annual contributions to a traditional IRA cannot exceed $7,000 ($8,000 if you are age 50 or older). Your contributions cannot exceed your taxable compensation for the year. |

| Roth IRA | A Roth IRA is funded with after-tax dollars, meaning you’ve already paid taxes on the money you invest in it. In exchange, your money grows tax-free. Once you retire and withdraw your savings, you won’t pay any taxes. | For 2024, total annual contributions to your Roth IRA cannot exceed $7,000 ($8,000 if you are age 50 or older). Your contributions cannot exceed your taxable compensation for the year. |

| SEPIRA | A SEP IRA (or Simplified Employee Pension) is a type of traditional IRA designed for self-employed individuals and small business owners with few employees. Like traditional IRAs, money in SEP IRAs is not taxable until withdrawn. Unlike traditional IRAs, these are funded only with employer contributions. | Contributions for the 2024 tax year can be up to 25% of compensation or up to $69,000, whichever is less. |

| SIMPLE WRATH | Unlike SEP IRAs, employees can make contributions to a SIMPLE IRA (or Employee Savings Incentive Matching Plan). SIMPLE IRAs are most commonly used by small business startups with fewer than 100 employees. Additionally, employers are required to match up to 3% of the employee’s salary or make non-elective contributions of 2%, up to an annual limit of $290,000 for 2021. | Employees can contribute up to $16,000 from their salary to a SIMPLE IRA in 2024, plus a $3,500 catch-up contribution for those over 50. |

| Spouse IRA | Spousal IRAs are intended for married couples and allow the working spouse to contribute to an account on behalf of a spouse who earns little or no income. To qualify for a spousal IRA, couples must file income taxes jointly. It’s worth noting that spousal IRAs are not co-owned. | Each spouse can contribute up to the same limit as a traditional IRA or Roth ($7,000 for 2024). However, the total of their combined contributions cannot exceed the taxable compensation reported on the joint tax return. |

Who can open an IRA?

You must have earned income from a W-2 job or self-employment to open an IRA, which means that virtually anyone with a job can open an IRA account, regardless of age.

A parent or legal guardian can set up an IRA for a minor through a custodial account. Once minors turn 18, or 21 in some states, they will have full access to their IRA account.

Types of IRA Rollovers

An IRA reversal — sometimes referred to as an “IRA rollover” — it allows you to transfer money from your previous employer-sponsored retirement plan to an IRA. Many people invest their savings to consolidate their previous employer’s 401(k) plans and avoid the hassle of tax penalties on early withdrawal.

However, there are some factors you should pay attention to when rolling over your IRA. If done incorrectly, the rollover could be considered a distribution or early withdrawal and be subject to tax.

Larry Sprung, founder and wealth advisor of Mitlin Financial, says there are two ways to avoid potential pitfalls.

“The simplest and least problematic option is direct rollover. With a direct rollover, you have the custodian of the current IRA write a check to the custodian of the new IRA for your benefit. And you, as the IRA holder, never take possession of the money,” Sprung says.

The second method is an indirect rollover, which will provide a check in your name that must be deposited within 60 days of receipt. If you don’t, the money will be fully taxable. You should also make sure that you do not select the option to withhold taxes when completing your indirect rollover request.

“If you withdraw money from a 401(k), the default is to withhold 20% for tax purposes, it’s very common for people to make the mistake of inadvertently withholding taxes unless they specify otherwise,” Sprung says.

Although the IRS allows only one indirect rollover in a 12-month period, there is no limit to the number of direct rollovers you can request.

“If you’re looking to transfer money and it’s not a direct transfer, you should really consult with a wealth advisor, a financial advisor, or your accountant to make sure you’re filling out the paperwork correctly,” Sprung adds.

Depending on the plan you have, your investments may retain their tax-deferred status when transferred directly into an IRA account. Some qualified plans include 401(k), money purchase, profit sharing, and defined benefit plans. If you are considering a Rollover IRA, check to see if your account is eligible for a rollover.

Beware of tax penalties for early withdrawal

You can take early withdrawals from an IRA before age 59½, but the money may be included as part of your gross income and subject to an additional 10% tax penalty. However, tax penalties are waived if the early withdrawal is for a qualifying distribution, or if you meet certain exceptions.

How do I open an IRA?

You can open an IRA account through a variety of financial institutions, including online banks.

Before you get started, take the time to compare providers. While the IRS requires no minimum contribution to open an account, some providers may require $500 to $1,000 as an initial deposit plus service fees, depending on the account. Other institutions may have lower or no minimum deposit requirements, so evaluate your options.