Key points

- The first quarter consensus number has bottomed and could rise as the season progresses, driving the market.

- Consensus data for the second, third and fourth quarters also increased, suggesting a sustained rally is possible.

- The FOMC poses a risk and could lead to a mid-summer correction if it does not follow through on interest rate cut expectations.

- 5 stocks we like best about the SPDR S&P 500 ETF Trust

We’re less than two weeks away from the start of the peak of the first-quarter earnings reporting season, and it looks like it could be a good time. Several factors suggest that the market rally could continue through the end of the period and perhaps into the end of the year. These include the fact that earnings are growing, the prospects of accelerating growth and upward revisions to the numbers. Risks include the FOMC and interest rate cuts, which will slowly be phased out of the market.

A trough in sentiment could turn into a tailwind

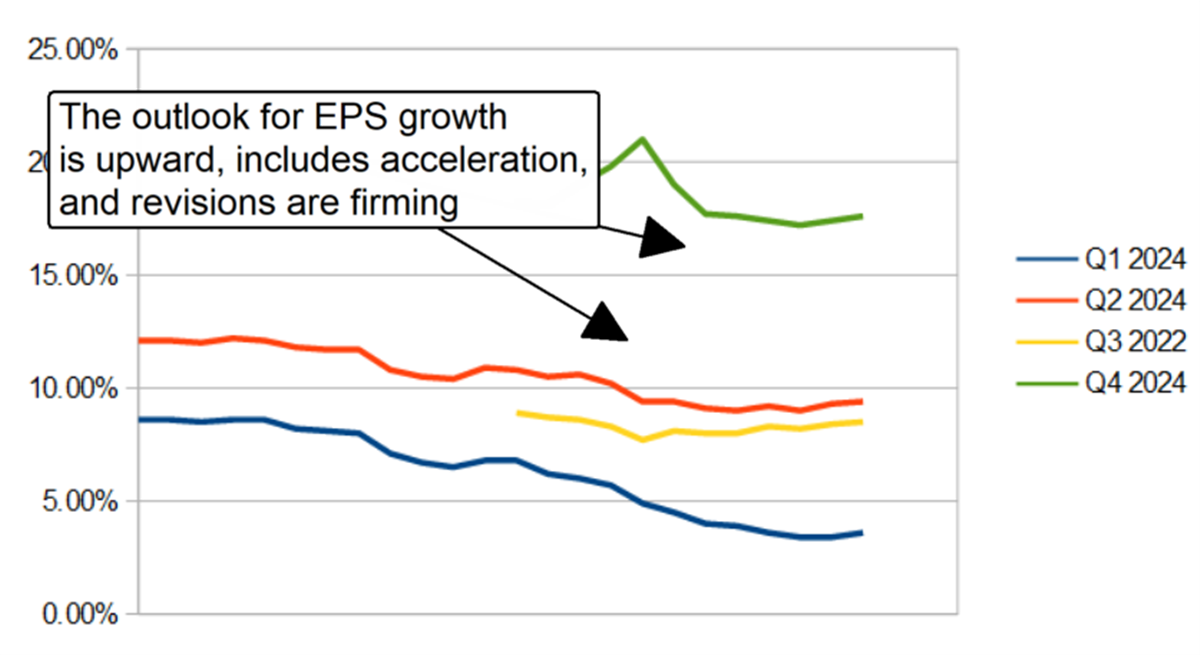

The consensus figure for the first quarter of 2024 S&P500 NYSEARCA: SPY Earnings growth reported by Factset has trended lower over the past year, but some signs in the data suggest the headwind is easing and could soon reverse.

The first is that earnings growth will persist into the first quarter and into 2024. This is an extension of a trend that began in 2023 and is expected to remain stable through 2025. The second is that earnings growth is expected to accelerate in the next four quarters and could beat current consensus. The S&P 500 tends to outperform the early-cycle consensus numbers each quarter by at least a few hundred basis points, which brings us to the third and perhaps most crucial factor: revisions.

The S&P 500 tends to outperform each quarter’s consensus figure, but each quarter’s figure also tends to show a pre-cycle downtrend. This year, at least for now, the downward trend in revisions has stopped. The Q1 data appears to have bottomed out, while the Q2, Q3 and Q4 data have flattened out and curved upwards. If this continues, it will likely follow the S&P 500 Index as the market prices in increased earnings potential, but there is risk. Downward revisions could occur if the results and guidance fail to impress.

Industry Results Will Be Mixed: AI Will Drive Growth

Results will be mixed on a sector basis, with only seven of the eleven countries expected to produce growth. The result is that upward revisions mean that the number of sectors and companies expected to see growth increases compared to the beginning of the period. At the discretion of the consumer NYSEARCA: XLY is the number one beneficiary. It is expected to post the second-strongest EPS growth in the industry and the consensus figure has increased 1,200 basis points over the past 90 days.

Amazon NASDAQ:AMZN is the driving force behind growth and reviews in the discretionary sector, but the strength is also seen in reviews for Nike NYSE:DI and cruise lines. Amazon is supported by consumer and technology spending: AWS represents an increasingly larger part of the business and is powered by artificial intelligence.

Information Technology NYSEARCA: XLK saw the second strongest revision in the first quarter. Expected to be the fourth strongest sector in terms of growth: consensus is up more than 700 basis points since the start of the quarter, led by NVIDIA NASDAQ:NVDA. NVIDIA is expected to see its earnings grow by triple digits; consensus is up 25% and could continue to grow ahead of the report.

The FOMC poses a threat to earnings growth

FOMC threatens S&P 500 earnings growth due to high interest rates rates are cutting consumer and business spending. The risk to the market is that the FOMC will not cut rates this summer, altering the earnings outlook. The latest inflation data has been uncooperative and the market is now reevaluating cuts. The best chance for a single cut is now July, and it could swing back, meaning the economic pivot that will spur earnings growth may not be in line with market expectations. In this scenario, first-quarter earnings reports could send the market to new highs, but there is a risk that the S&P 500 will top out by June and correct over the summer.

Before you consider the SPDR S&P 500 ETF Trust, you’ll want to hear it out.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and SPDR S&P 500 ETF Trust wasn’t on the list.

While the SPDR S&P 500 ETF Trust currently has a “hold” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

What stocks are being purchased by major institutional investors, including hedge funds and endowments, in today’s market? Click the link below and we’ll send you MarketBeat’s list of thirteen stocks that institutional investors are buying as fast as they can.

Get this free report