Let’s all appreciate the fact that we are currently in a bull market with the S&P 500 (SPY) hitting new highs once again this week. However, it is prudent to think about what could create a bear market so as to stay alert. That’s why Steve Reitmeister shares insights on the 2 main causes of bear markets. And how much concern it should be for investors right now. Continue reading below for more information.

A market that refuses to go down… will inevitably go up

And this simple logic is exactly what we see happening at this stage. Even if the start date of the Fed’s rate cuts is pushed back, investors simply don’t want to lose their grip on the stock market.

That helps explain why the S&P 500 (SPY) soared to new highs once again on Thursday, even as Fed officials sing in unison about the dangers of cutting rates too soon. It must be assumed that this positive price trend will remain in place until a dramatically negative catalyst occurs.

So this leads to the question…What could derail this bull market?

This will be the focus of today’s discussion.

Comment on the market

One of my favorite investing sayings is:

“It’s a bull market until proven otherwise”

This means that the natural gravity of the stock market is to move higher. This helps explain why the average bull market lasts 63 months while the average bear market lasts only 13 months. This is a 5 to 1 advantage in favor of a bull market.

Or to put it another way… it’s harder to create a bear market than most people realize. So, you really need extraordinary events to shake stocks off their bullish axis.

When you boil it down, there are only 2 ingredients that create a bear market. Let’s explore both below.

The first, and most obvious, is the idea that a recession is brewing. This lowers earnings prospects and reduces risk-taking, leading to a lower PE for each stock. This combination culminates in an average bear market decline of 34% for the S&P 500.

The second reason comes from a stock price bubble bursting (often with a recession following from all that loss of household net worth). The two most obvious examples are 1929 and the 2000 tech bubble.

Yes, some may reference the Great Recession of 2008. But that was because of a real estate stock bubble that led to bank failures. This is certainly an interesting situation… but different from the overpricing of stocks leading to their eventual fall.

On the recession front, the economy continues to proceed at a strong pace, with the GDP Now estimate for the first quarter rising to +2.5%. This value is very close to the long-term average of +2.7% and certainly does not suggest the formation of a recession.

Of course, there is always the concern that the Fed will overstay its welcome with high rates generating a future recession. This fear stems from 12 of the last 15 rate hike cycles ending in recession. However, it appears that Powell and company are good students of history and are on track to manage a soft landing that allows them to cut rates before a recession hits.

I recently saw that the market’s current PE (20.7) is in the top 5% of all time. This causes us to stop in their tracks and consider whether we are overvalued.

The counterargument is that investors now understand the risk and return of the stock market better than that of bonds and cash. This has led to higher PEs for stocks over the last 20-30 years, making long-term historical standards a bit outdated.

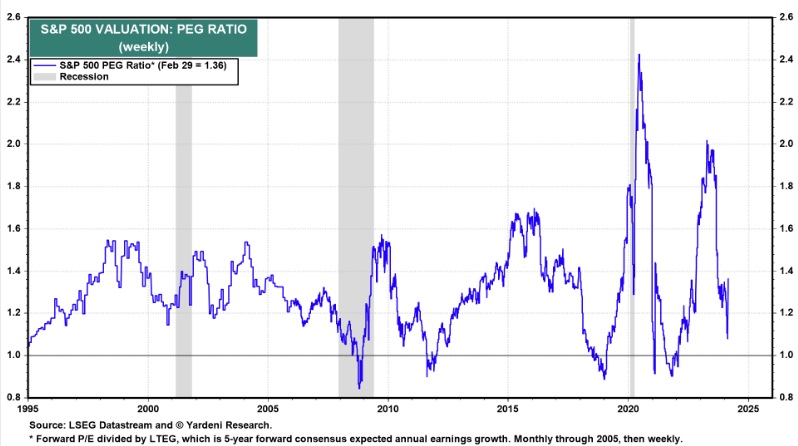

As a counterargument I want to share this PEG ratio graph from 30 years ago:

The PEG ratio is my favorite valuation metric as it tells you how much you are willing to pay for each unit of earnings growth. This means that a tech stock growing earnings 20% per year SHOULD have a higher PE than a sleepy utility company with meager 3% earnings growth.

As you can see, the current PEG level for the market has been something of an intermediate level for the last three decades and is no cause for alarm on the valuation front.

Yet there are definitely groups that are valued a little too much, such as Magnificent 7 stocks and some of the “hip” AI companies. Interestingly, Tesla has already finally come down from its overly lofty heights with shares 40% off the highs. I’d like to see some of that profit-taking go to these other names, while that money flows to other worthy companies at more attractive valuations.

Taking it back to the top, it’s a bull market until proven otherwise. And since we just looked at what could derail the market (recession and valuation), we are on fairly safe footing on that front as well.

Therefore, continue to invest fully in stocks. Just keep an eye on value right now, as there are indeed some over-mature stocks set to collapse.

Are you interested in my favorite stocks right now?

Continue reading below to discover them now…

What to do next?

Check out my current 12-stock portfolio filled to the brim with the outperforming advantages found in our unique POWR Ratings model. (Nearly 4 times better than the S&P 500 Index dating back to 1999)

This includes 5 recently added hidden small caps with huge upside potential.

I also have 1 specialty ETF that is incredibly well positioned to outperform the market in the weeks and months ahead.

This is all based on my 43 years of investing experience watching bull markets… bear markets… and everything in between.

If you’re curious to learn more and want to see these 13 hand-picked lucky trades, click the link below to get started right away.

Steve Reitmeister’s Trading Plan and Top Picks >

Wishing you a world of successful investing!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO of StockNews.com and editor of Reitmeister Total Return

SPY shares traded at $514.66 per share on Friday morning, down $0.15 (-0.03%). Year to date, SPY has gained 8.28%, compared to a % gain in the benchmark S&P 500 index over the same period.

About the author: Steve Reitmeister

Steve is better known to StockNews audiences as “Reity.” He is not only the CEO of the company, but also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Find out more about Reity’s background, along with links to her most recent articles and headline picks.

Moreover…

The mail What would cause a bear market now? appeared first StockNews.com