tadamichi/iStock via Getty Images

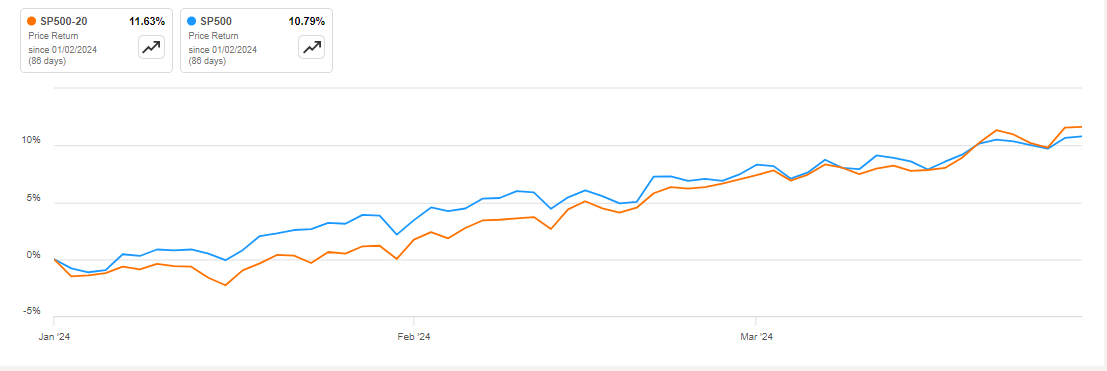

SPDR Industrial Select Sector Fund ETF (NYSEARCA:XLI), which tracks the S&P 500 industrials sector, rose approximately 11.63% in the first quarter of 2024, compared to an increase of 2.80% in the same period last year.

The industrial sector (SP500-20) – which has a weight of 8.5%. on the S&P 500 – rose another 11.63%, marginally outperforming the broader index, which rose about 10.79% in the January-March period.

On a comparative basis, the industrial sector performed better than some of its competitors, such as materials and consumer staples, while lagging behind the technology sector, among others.

However, a recent report indicated that approximately 37 of the 78 industrial stocks in the S&P 500 index hit record highs.

In the broader S&P 500 index, about 130 stocks have hit all-time highs this year, with industrials recording the highest percentage and largest number of stocks in any sector to reach a record high in 2024, the analysts noted. data from S&P Global Market Intelligence.

The industrial sector has seen regular inflows and outflows of US equity funds, with March 5 recording the highest inflows since 2024 at $518.30 million. As of March 21, the sector recorded net flows of approximately $800.27 million.

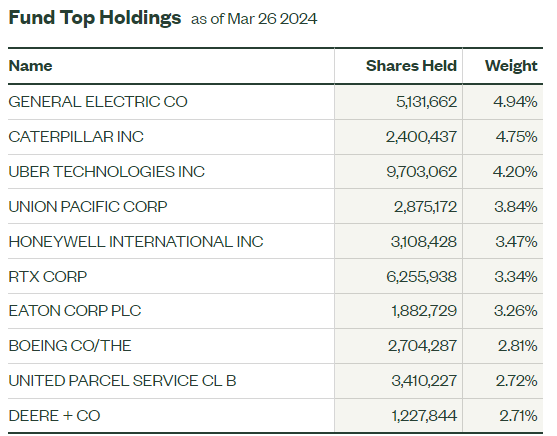

The top five movers in the first quarter (As of March 27)

- Winners: General Electric (GE) +40.04%

- Eaton Corp. (ETN) +29.53%

- PACCAR Inc. (PCAR) +26.81%

- Howmet Aerospace (HWM) +25.83%

- Hubbell Inc. (HUBB) +25.09%

- Losers: Boeing (BA) -27.34%

- CH Robinson around the world (CHRW) -15.27%

- Robert Half (RHI) -11.02%

- Rockwell Automation (ROK) -7.88%

- United Parcel Service (UPS) -7.41%

What analysts expect

The two Seeking Alpha analysts surveyed in the last 90 days rated the Industrials sector (XLI) as a Hold. Analyst InSight Analytics believes XLI has the potential to benefit investors with up to 5% upside on state programs totaling $1.8 trillion that are expected to support infrastructure renewal, green energy and investment in other sectors across the industry.

“However, aerospace and defense, which is not XLI’s main allocation, appears to benefit the most due to tailwinds,” the analyst added.

Morgan Stanley, while estimating the base price target of the S&P 500 for the next twelve months to be 4,500, remained neutral on industrials, energy and financial sectors compared to overweight on healthcare, consumer staples and utilities .

What the quantitative measures say

Seeking Alpha’s Quant Ratings recommended the ETF as a buy, rating it 4.09 out of 5. The ETF was rated A- on dividends compared to A three months ago. Its momentum and liquidity outlook were rated A- and A+, respectively.