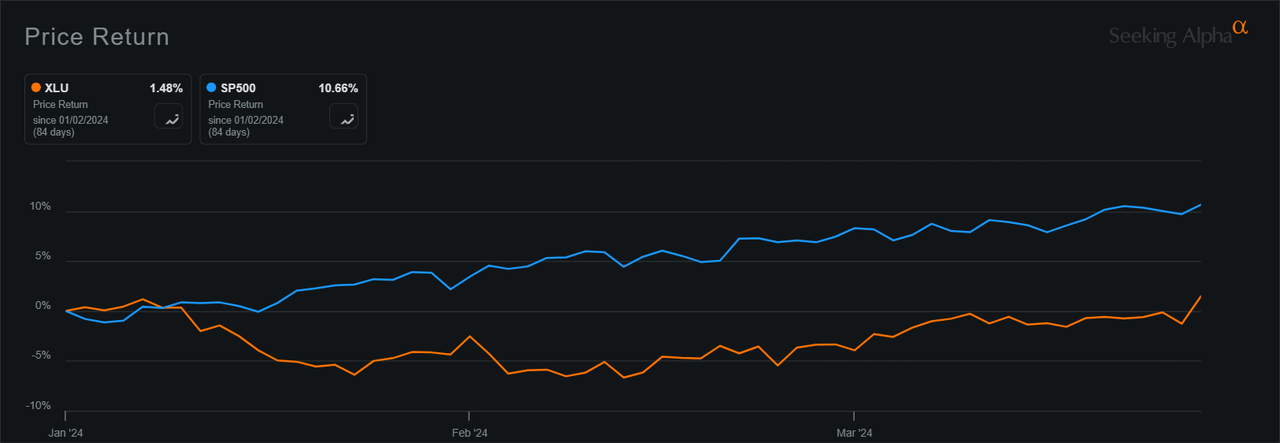

The Utilities Select Sector SPDR Fund ETF (NYSEARCA:XLU), which tracks the utilities sector of the S&P 500 index, increased by approximately 1.5% in the first quarter of 2024, well below the performance of the broader S&P 500 index, which increased by 10.7% during the same period.

THE The ETF had fell by 10.2% in 2023, while the reference index increased by 24.7% for the same period.

The index, which includes companies ranging from electricity suppliers to water suppliers, ranks second to last among the best-performing S&P 500 sectors year to date.

XLU has $11.92 billion in assets under management as of March 28, 2024, and its largest constituents include NextEra Energy (NEE), Southern (SO), Duke Energy (DUK), Constellation Energy (CEG) and Sempra (SRE ).

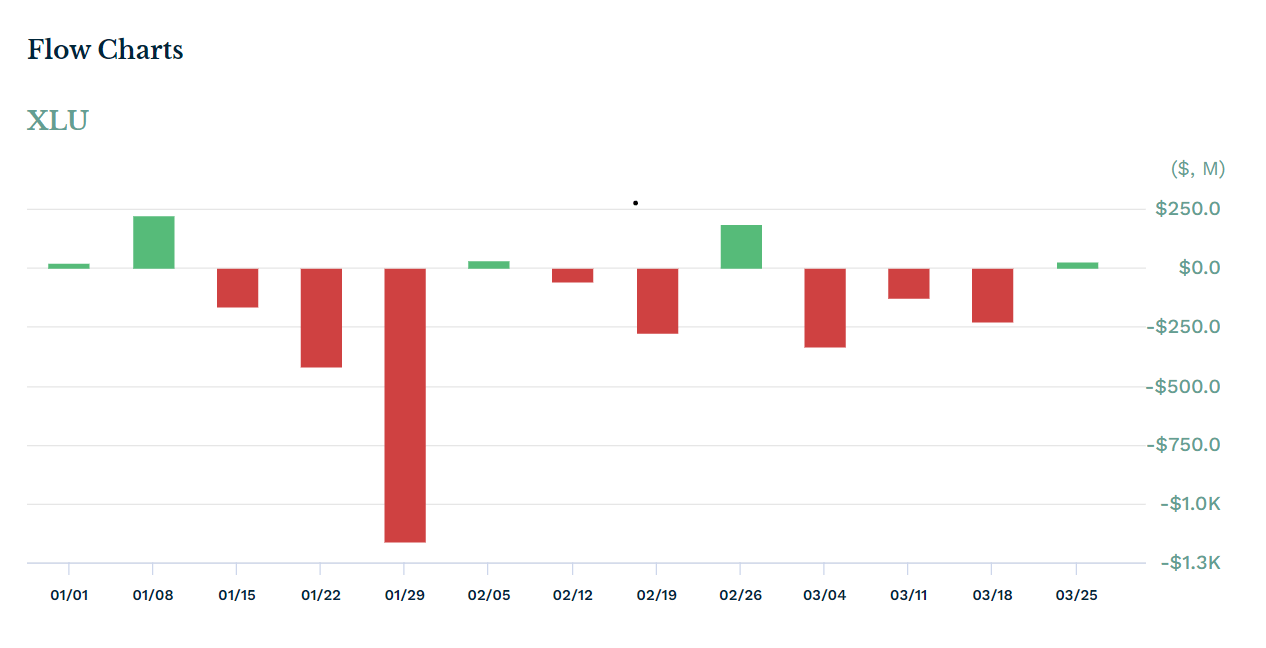

US equity fund flows into and out of the utilities sector were mostly in the red in the first quarter. The Utilities-focused ETF has seen net flow of -$2,255.96 million to date.

Top mover since the beginning of the year

- Winners: Constellation Energy (CEG) +58.14%

- NRG Energy (NRG) +30.93%

- Public Service Enterprise Group (PEG) +9.21%

- American Electric Power (AEP) +6.01%

- FirstEnergy (FE) +5.35%

- Losers: Xcel Energy (XEL) –13.18%

- American Water Works (AWK) -7.41%

- PG&E (PCG) -7.04%

- AES Corp. (AES) -6.86%

- Sempra (SRE) -3.88%

What the quantitative measures say

XLU received a Hold rating from Seeking Alpha’s Quant Rating system with a score of 2.89 out of 5, supported by A+ in liquidity and A in the expenses category. The ETF earned a C+ for momentum, an A+ for dividends but a D- for risks.

What analysts expect

Seeking Alpha contributor Skeptical 12 said in its March 13 report that the Utility ETF has underperformed the S&P 500 since 2021, giving investors only a total return of 11.41% compared to the S&P 500’s 35.76%.

“Today I will initiate coverage of XLU with a sell rating. The utilities sector has struggled for multiple reasons with rising costs, higher rates and also increasing levels of capital spending. This sector also faces increased regulatory scrutiny with consumers also more concerned about price levels. Prices remain elevated even as inflation rates have been declining over the past year, and this sector is likely to continue to consistently underperform the S&P 500 Index and other more attractive income investments, even if Powell begins to ease monetary policy ,” the contributor wrote.