the horrors

Maybe it was the prevalence of stock trading apps combined with stimulus checks, but adults under 40 have seen their wealth increase more than middle-aged or older adults since 2019, according to a study by the Federal Reserve Bank of New York. Economy of freedom.

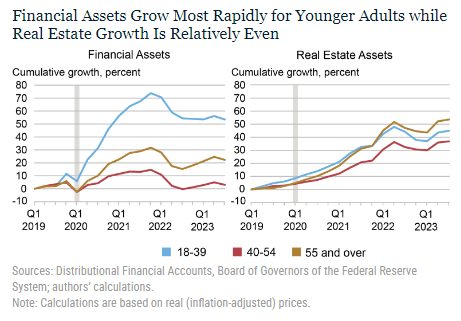

For individuals aged 39 and under, wealth increased by a whopping 80%. Compare that to those aged 40 to 54, who saw a 10% increase in wealth, and those aged 55 and older, who saw a 30% gain.

Financial assets contributed most to the increase. For those under 40, the real value of their financial assets increased by more than 50% between 2019 and 2023. The 40-54 group saw an increase of just 3%, while the over 50 group saw an increase of 20%.

The under-40 group likely invested in stocks and mutual funds during the period. The percentage of their financial assets in corporate stocks and mutual funds increased to 25% from 18% in the first quarter of 2019. This is a 39% increase. Meanwhile, the over-55 group saw their share of stock/mutual fund portfolios increase by 12%, while the 40-55 group saw their share of stock/mutual fund portfolios drop from 30% to 25%.

In contrast, the percentage of assets held in pensions decreased for both the under 40 and over 55 age groups, but increased for the 40-55 age group.

“This greater exposure to stocks – the fastest-growing financial asset class during the period – allowed younger adults to experience higher growth in both financial assets and overall wealth,” the report said.

The study’s data, however, failed to distinguish between changes in investments and changes in returns, so the results are a combination of both factors.

This change also reflects the fact that younger adults can afford to invest in risky assets at a higher rate than older adults. Additionally, because young adults are closer to the start of their careers, their income is generally lower. Therefore, they received much of the COVID-era stimulus checks.

It is important to note, however, that even as young adults’ wealth increases, they still hold a disproportionately smaller amount of the total wealth. In 2019, individuals under 40 held just 4.9% of total U.S. wealth, although they made up 37% of the adult population. Meanwhile, those over 54 make up a similar share of the population, but hold 71.6% of total wealth.

“By analyzing changes in the distribution of wealth since 2019, we find that faster growth in wealth among young adults has led to a limited reduction in age-based wealth inequality over the past four years,” it said.

Ticker related to online trading: Robinhood (NASDAQ:HOOD), BLACK (NYSE:SW), Morgan Stanley (NYSE:MS), Interactive Brokers (NASDAQ: IBKR), SoFi Technologies (NASDAQ:SOFI), Financial Ally (NYSE: ALLY).